Stablecoins have rapidly emerged as the backbone of onchain subscriptions, transforming how businesses and developers approach recurring billing in the crypto economy. With Stripe’s recent rollout of stablecoin subscription payments, the landscape for Web3 SaaS, digital content creators, and decentralized service providers is evolving at breakneck speed. Instead of clunky manual approvals, customers can now authorize recurring payments from their wallets, enabling automated, seamless transactions that mirror the best of traditional fintech, without the volatility or friction of native crypto tokens.

Stablecoins: The Engine of Predictable, Global Subscription Billing

At the core of this revolution is the stablecoin, digital assets like USDC that are pegged to the US dollar. Unlike volatile cryptocurrencies, stablecoins offer predictable value and instant settlement, making them ideal for recurring billing cycles. Platforms such as Stripe have embraced this by enabling businesses to accept USDC payments on fast, low-fee networks like Base and Polygon, opening the door for global users, including those in underbanked regions, to access subscription services without the hurdles of legacy banking.

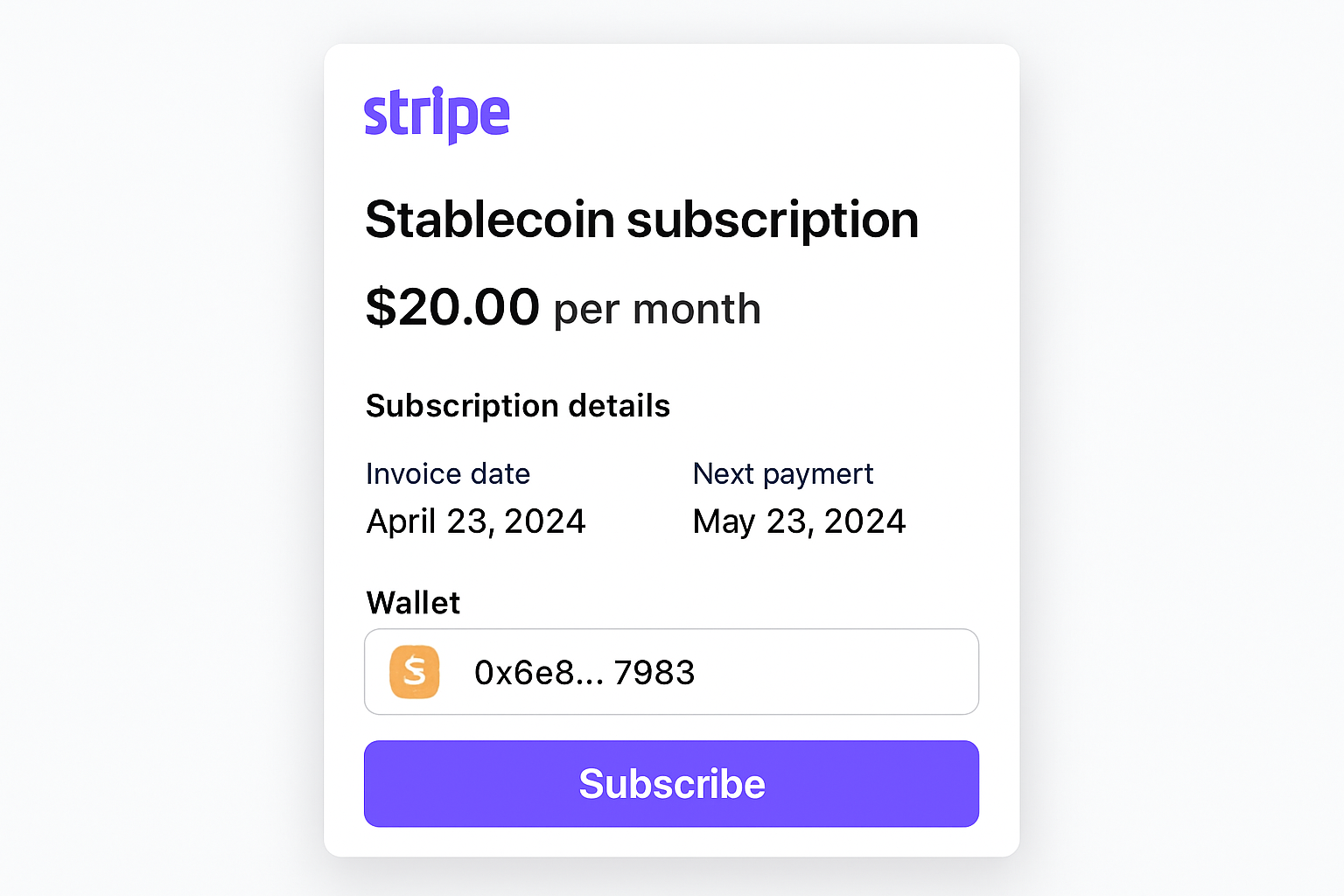

Stripe’s smart contract innovation allows users to save their wallet as a payment method and pre-authorize recurring transactions, no more re-signing every month. This is a game changer for both merchants and consumers, eliminating a major pain point in crypto payments and providing a user experience that rivals the best Web2 platforms. For a deeper dive into how Stripe is shaping this market, check out their official announcement at stripe. com.

Accurate Proration: Solving the Web3 Billing Challenge

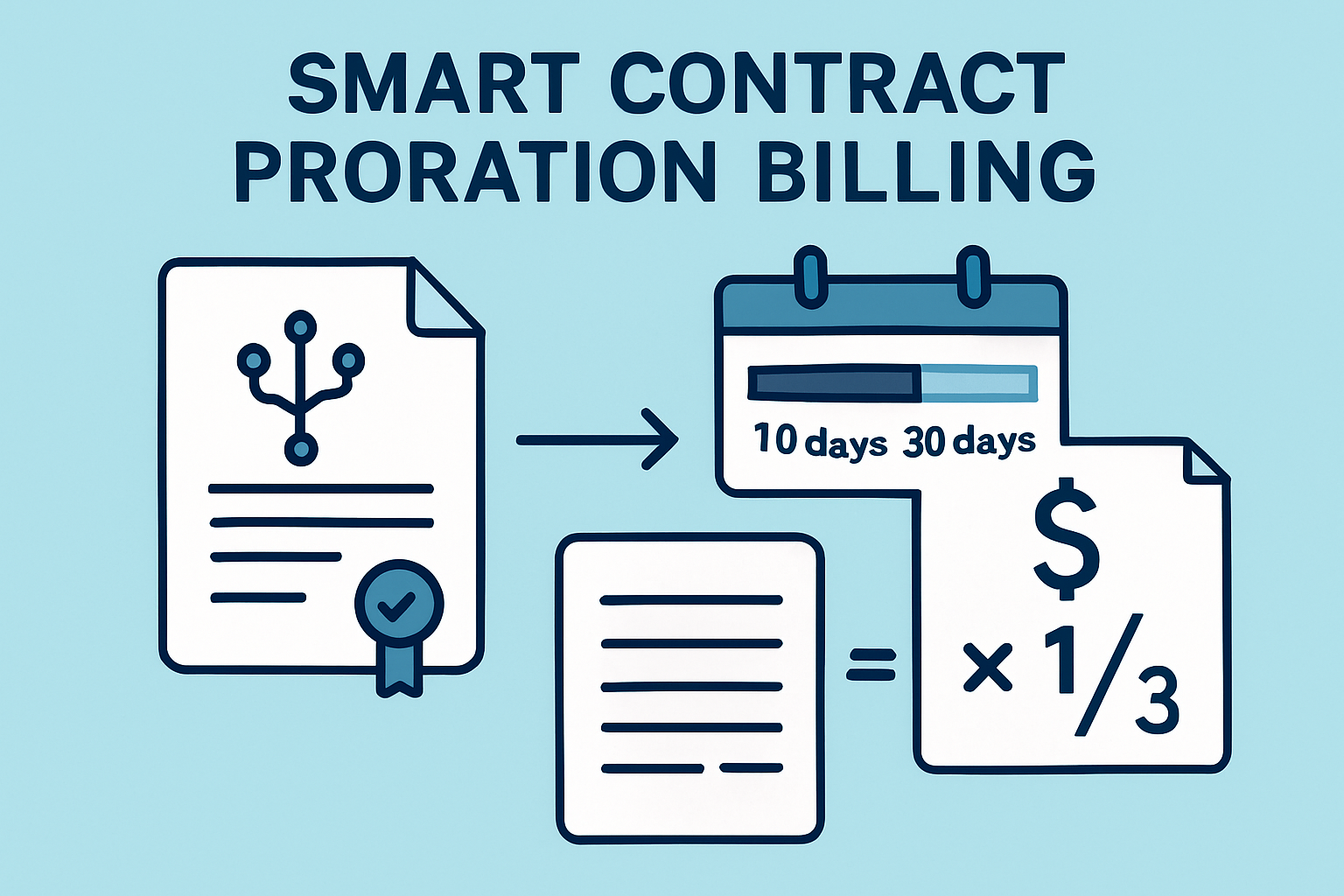

One of the toughest challenges in subscription management is proration: calculating the exact amount owed when a user upgrades, downgrades, or pauses their plan mid-cycle. In the Web3 world, this is further complicated by the need for transparency and immutability. Enter smart contracts: platforms like SubscribeOnChain. com use programmable logic to automate proration, ensuring that every cent is accounted for. This not only enhances trust but also reduces billing disputes and manual reconciliation.

Smart contracts can instantly recalculate subscription fees based on usage and changes, then execute precise, onchain payments in stablecoins. This level of automation is virtually impossible with legacy payment rails and gives Web3 businesses a significant edge in operational efficiency.

Why Businesses Are Embracing Onchain Subscription Models

The adoption of stablecoin-powered recurring billing isn’t just about tech novelty, it’s about measurable business impact. Here’s what’s driving the shift:

Key Benefits of Stablecoin Recurring Payments for SaaS & Digital Content

-

Predictable Revenue with Stablecoins: Accepting stablecoins like USDC ensures subscription payments maintain a consistent value, protecting both businesses and customers from crypto price volatility.

-

Seamless Onchain Automation via Stripe: Platforms such as Stripe now support recurring stablecoin payments, letting customers authorize their wallets for ongoing charges without re-signing each transaction—streamlining the subscription experience.

-

Accurate Proration with Smart Contracts: Onchain smart contracts automatically calculate and adjust billing for upgrades, downgrades, or pauses, ensuring precise charges and transparent billing cycles.

-

Lower Transaction Costs: Stablecoin payments on networks like Base and Polygon offer reduced fees compared to credit cards or bank transfers, improving margins for SaaS and content platforms.

-

Instant Global Access: Stablecoins enable instant, borderless payments, allowing businesses to reach customers worldwide—including those in underbanked regions—without the friction of legacy banking.

Stablecoin payments reduce transaction costs, speed up settlement, and eliminate currency conversion headaches. For SaaS providers and digital platforms, this means more predictable cash flow and a smoother experience for global customers. Stripe’s system even handles automatic fiat settlement for merchants, bridging the gap between crypto-native and traditional finance models. For more details on recurring billing with stablecoins, visit stripe. com.

In the next section, we’ll break down how decentralized invoicing and dynamic billing cycles are reshaping the economics of subscription businesses, and why proration accuracy is now a competitive advantage in the Web3 era.

Decentralized Invoicing and Dynamic Billing: The New Standard

Traditional invoicing processes often rely on centralized systems that can be opaque and error-prone. In contrast, decentralized invoicing leverages the transparency of blockchain, allowing every party to verify transactions, billing cycles, and proration calculations in real time. This not only minimizes disputes but also builds trust with subscribers, who can independently audit every payment and adjustment.

Dynamic billing cycles, powered by smart contracts, further enhance this model. When a subscriber upgrades, downgrades, or pauses their plan, the contract recalculates the exact amount owed and issues a prorated invoice, automatically, onchain, and in stablecoins. The result is a seamless, adaptable billing process that eliminates the need for manual intervention, even in complex usage scenarios.

Developers and finance teams can now focus on growth and customer service instead of chasing down failed payments or reconciling mismatched invoices. This is a fundamental shift, especially for global SaaS and digital content businesses where cross-border payments and currency volatility previously posed major headaches.

Real-World Impact: From AI Startups to Global Creators

The benefits of stablecoin-powered onchain subscriptions are already being realized across diverse sectors. AI companies, digital content creators, and SaaS providers are leveraging these systems to reach new markets and streamline their finances. Stripe’s support for USDC payments on Base and Polygon, for example, lets businesses tap into over 400 wallets worldwide, with instant, low-fee settlement. Read more on Bankless.

For creators and decentralized platforms, stablecoin recurring payments mean they can offer subscriptions to users in regions where credit cards are unreliable or unavailable. The combination of predictable pricing and transparent, programmable billing is proving to be a game changer for the next generation of Web3 businesses.

What’s Next? The Road Ahead for Onchain Subscriptions

As stablecoin adoption accelerates, expect to see even more advanced features, like token-gated memberships, usage-based billing, and real-time analytics, integrated into onchain subscription platforms. The ability to automate every aspect of the billing lifecycle, including proration and invoicing, makes it easier for businesses to scale globally without sacrificing accuracy or compliance.

Ultimately, the convergence of stablecoins, smart contracts, and decentralized invoicing is driving a new era of recurring billing: one that’s faster, cheaper, and more transparent than anything legacy systems can offer. For SaaS providers, digital content creators, and decentralized apps, embracing onchain subscriptions with accurate proration isn’t just a technical upgrade, it’s a strategic imperative for thriving in the Web3 economy.