Stablecoins are rapidly transforming the landscape of onchain subscription payments, offering SaaS and Web3 platforms a rare blend of price stability, global reach, and operational efficiency. While crypto’s volatility has historically posed a barrier to mainstream adoption, stablecoins like USDC, pegged 1: 1 to the US dollar, are eliminating this friction, making recurring billing on blockchain both practical and compelling.

Why Stablecoins Are a Game Changer for Blockchain SaaS Subscriptions

The rise of stablecoin recurring billing is not just a technical upgrade, it’s a strategic leap for businesses seeking predictable revenue and global customer access. Unlike traditional banking rails, stablecoins settle transactions instantly, with lower fees and no cross-border red tape. For SaaS and content platforms, this means subscriptions can be billed and paid from anywhere, at any time, without the headaches of currency conversion or delayed settlements.

Key Advantages of Stablecoin Subscription Payments

-

Price Stability: Stablecoins like USDC are pegged to the US dollar, ensuring predictable subscription costs and shielding businesses and users from crypto volatility.

-

Instant Settlement: Platforms such as Stripe now enable near-instant settlement of recurring payments, eliminating traditional banking delays and improving cash flow.

-

Lower Transaction Fees: By bypassing intermediaries, stablecoin payments—supported by providers like Stripe and FreeBnk—often incur reduced processing fees compared to credit cards or wire transfers.

-

Global Accessibility: Stablecoins allow SaaS and Web3 platforms to accept payments from customers worldwide, including those in underbanked regions, without reliance on local banking infrastructure.

-

Seamless Onchain Automation: Smart contracts, such as those developed by Stripe for recurring payments, enable automated wallet debits without repeated user approvals, streamlining the subscription process.

-

Enhanced Crypto Adoption: The integration of stablecoin subscriptions by major payment processors like Stripe is accelerating mainstream crypto adoption among SaaS and Web3 businesses.

-

Interoperability Across Blockchains: Stablecoin subscriptions can be processed on multiple blockchains, including Ethereum, Polygon, Base, and Solana, broadening user and business options.

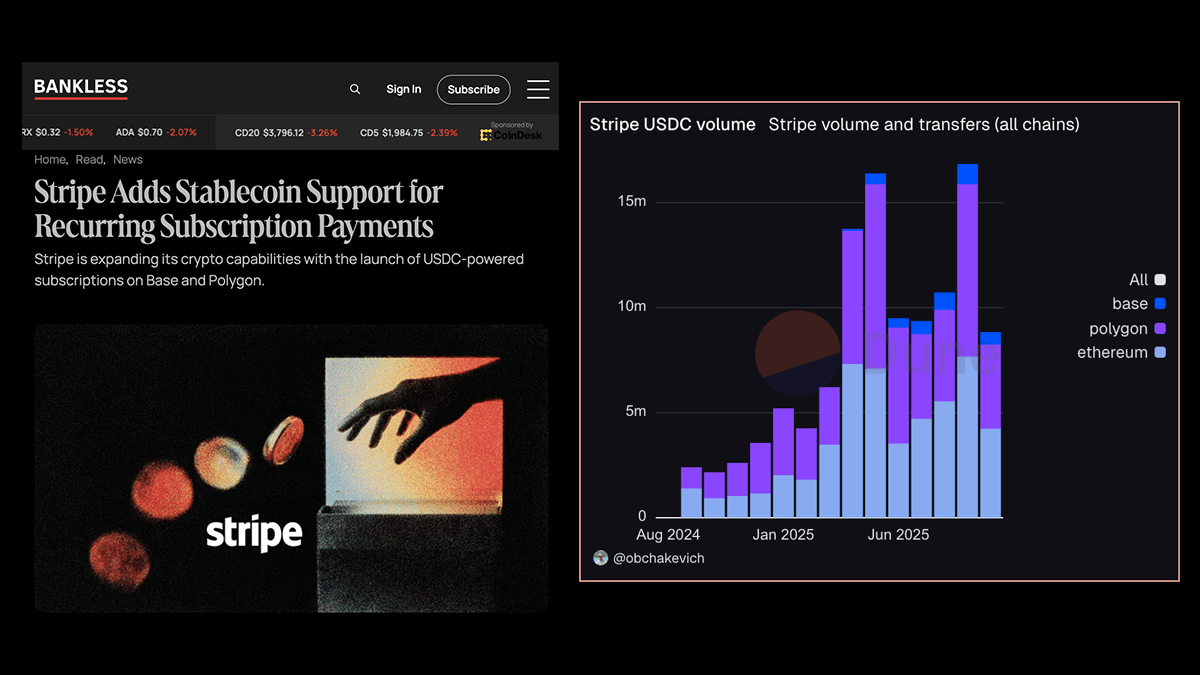

Recent market data underscores the momentum. In October 2025, Stripe launched stablecoin subscription payments, allowing U. S. businesses to accept recurring USDC payments across Ethereum, Polygon, Base, and Solana. This integration supports over 400 crypto wallets, removing onboarding friction for both crypto-savvy and mainstream users. Stripe’s innovation isn’t just about accepting stablecoins; it’s about making onchain proration, dynamic blockchain invoicing, and seamless recurring payments accessible to all.

Innovations in Onchain Subscription Management: From Proration to Smart Contracts

One of the most significant advances is the use of smart contracts to automate and streamline the subscription lifecycle. Stripe’s new smart contract lets customers authorize their wallets for automatic debits, eliminating the need to manually approve every transaction. This tackles the notorious problem of signature fatigue in Web3 and SaaS, paving the way for truly automated, non-custodial recurring payments. For a deeper dive into how smart contracts are solving missed payments and signature fatigue, see this analysis.

This shift isn’t theoretical. AI companies like Shadeform report that 20% of their payment volume now flows through stablecoins, drawn by lower costs and near-instant settlement. Meanwhile, platforms such as FreeBnk are enabling businesses to accept recurring USDC payments with blockchain-native smart contracts, further enriching the ecosystem of web3 subscription management.

Global Reach and Financial Inclusion: Stablecoins as a Borderless Solution

Perhaps the greatest promise of stablecoin SaaS payments lies in their global accessibility. By bypassing the limitations of traditional banking, stablecoins empower businesses to reach customers in underbanked regions, expand internationally without friction, and offer transparent, programmable invoicing. For digital creators, decentralized service providers, and SaaS companies alike, this unlocks new revenue streams and operational resilience.

As stablecoin adoption accelerates, expect to see more platforms integrate features like onchain proration and dynamic invoicing, ensuring customers are billed accurately for partial periods and usage-based tiers. The infrastructure is maturing fast, and the competitive edge is shifting to those who can leverage these tools for seamless, transparent, and efficient subscription management.

Forward-thinking SaaS providers and Web3 startups are already capitalizing on these advancements. By integrating stablecoin payment rails, they’re not only reducing operational costs but also positioning themselves at the forefront of a financial paradigm shift. The power to accept recurring payments from anywhere in the world, without intermediaries or unpredictable settlement times, means businesses can focus on growth, product, and user experience instead of legacy payment headaches.

From a strategic perspective, onchain proration and dynamic blockchain invoicing are set to redefine how subscriptions are managed. Proration ensures customers pay only for what they use, even if they upgrade, downgrade, or pause mid-cycle. This level of billing accuracy, combined with the transparency of blockchain records, builds trust with users and simplifies compliance for businesses, no more opaque billing cycles or reconciliation nightmares.

What to Watch: The Next Wave of Stablecoin Subscription Features

The next twelve months will likely see an explosion in advanced features for stablecoin SaaS payments. Expect deeper wallet integrations, multi-chain support, real-time analytics, and automated dispute resolution. As major payment processors like Stripe set new standards, independent platforms will push the envelope with modular APIs, no-code onboarding, and customizable smart contract templates for every imaginable subscription model.

Top Innovations in Stablecoin Subscription Management

-

Stripe’s Onchain Stablecoin Subscription Payments: Stripe now enables businesses to accept recurring USDC payments on Ethereum, Polygon, Base, and Solana, supporting over 400 crypto wallets for seamless SaaS and Web3 subscriptions.

-

Smart Contract-Based Recurring Payment Authorization: Stripe’s smart contract allows customers to pre-authorize automatic stablecoin debits, removing the need for manual transaction approvals each billing cycle and improving user experience.

-

FreeBnk’s Recurring USDC Payment Solutions: FreeBnk offers infrastructure for businesses to manage onchain USDC subscriptions using programmable smart contracts, streamlining recurring billing for SaaS and Web3 platforms.

-

Multi-Chain Stablecoin Support for Global Reach: Platforms like Stripe and FreeBnk support stablecoin payments across multiple blockchains, enabling businesses to tap into global markets and accept payments from users worldwide.

-

Adoption by AI and Web3 SaaS Companies: Companies such as Shadeform are seeing significant payment volume shift to stablecoins, citing cost efficiency and instant settlement as key drivers for adopting stablecoin-based subscriptions.

For developers, the opportunity is clear: leverage composable onchain tools to deliver seamless recurring billing experiences. For business leaders, now is the time to experiment with stablecoin invoicing, pilot a new market segment, reduce currency risk, or offer crypto-native perks that attract a new generation of users.

Ultimately, the mainstreaming of stablecoin recurring billing will do more than streamline payments, it will unlock entirely new business models. Think decentralized pay-as-you-go services, micro-subscriptions for digital content, or transparent revenue sharing for DAOs and creator collectives. As these capabilities mature, the distinction between traditional and blockchain-native SaaS will blur, and those who adapt early will shape the future of subscription commerce.