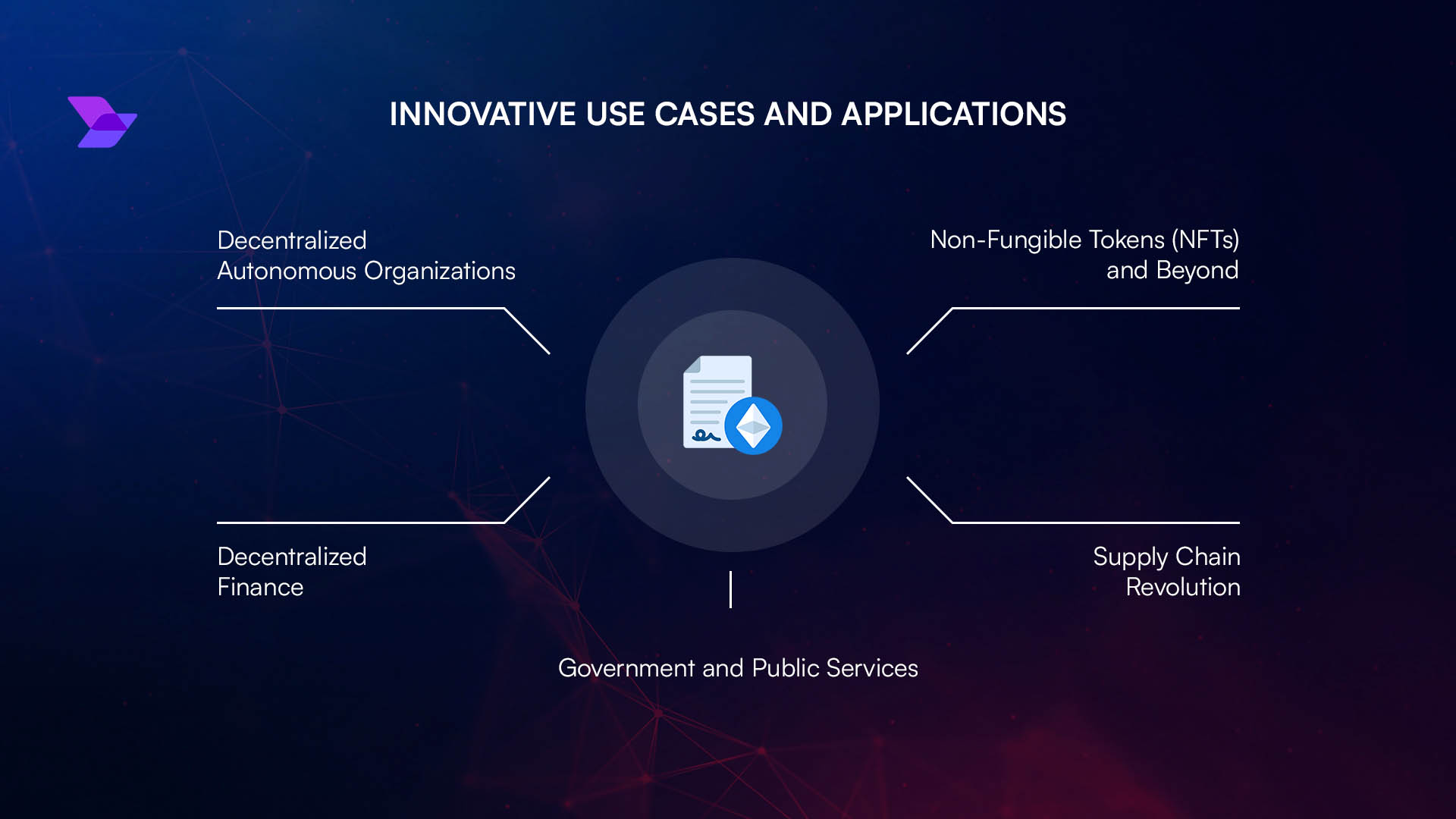

Automating refunds and adjustments in blockchain subscription platforms is rapidly becoming a defining feature for SaaS providers, digital content creators, and decentralized service businesses aiming to deliver seamless user experiences. Traditional systems often leave refunds and proration as manual processes, which can lead to delays, errors, and user frustration. In contrast, blockchain-based solutions leverage smart contracts to ensure every adjustment is transparent, accurate, and executed with minimal human intervention.

The Complexity of Subscription Adjustments: Why Automation Matters

Subscription models are inherently dynamic. Customers frequently upgrade, downgrade, or cancel their plans mid-cycle. Each of these actions triggers the need for recalculating charges or issuing credits based on prorated usage. In legacy payment systems like Stripe or Paddle, negative prorations (credits) are not automatically refunded, while positive prorations (additional charges) aren’t immediately billed, manual action is required (Stripe Documentation). This gap introduces operational overhead and the risk of inconsistent customer experiences.

In the blockchain context, proration means calculating the exact cost for the portion of a service used within a billing cycle. For instance, if a user cancels an annual plan after nine months, they should receive a refund for the remaining three months, no guesswork or manual reconciliation required. Automating these adjustments not only ensures fairness but also builds trust through transparent record-keeping onchain.

Smart Contracts: The Backbone of Automated Refunds

Smart contracts are self-executing agreements that live on blockchain networks such as Ethereum or Layer-2 solutions like Arbitrum. They encode business logic directly into code, handling everything from recurring payments to access control and refund logic without manual oversight. As highlighted by Mitosis University, standards like ERC-1337 were designed specifically for recurring subscriptions but broader adoption has been slow due to gas fees and UX hurdles.

Recent innovations are addressing these pain points by utilizing Layer-2 networks and account abstraction to make onchain subscriptions more efficient and user-friendly. For example:

Platforms Using Smart Contracts for Automated Refunds

-

Autopay Pro: This platform leverages blockchain technology to automate payment distribution and refunds, ensuring instant fund transfers and transparent, protocol-compliant operations for subscription services. Learn more.

-

Calypso Finance: Specializes in recurring crypto payments and automates refunds for unused subscription periods, reducing churn and streamlining financial adjustments for businesses. Explore Calypso Finance.

-

Inqud: Offers Web3-based recurring payments with automated refund mechanisms, allowing businesses to manage regular crypto transactions and process adjustments efficiently. Discover Inqud.

-

MoneyHash: Provides automation tools that connect payment systems and internal workflows, enabling seamless, programmable refunds and subscription adjustments across blockchain-based platforms. See MoneyHash automation.

-

Refund Protocol by Circle Internet: Enables secure, non-custodial refunds for stablecoin payments using transparent, smart contract-based dispute resolution, ideal for decentralized subscription models. Read about Refund Protocol.

This approach brings several immediate benefits:

- Efficiency: Refunds that used to take 10, 15 minutes can now be processed in under 30 seconds (Tweave Tech Case Study).

- Accuracy: Proration logic is enforced by code, eliminating human error.

- Transparency: Every adjustment is recorded immutably onchain.

- User Trust: Customers see real-time updates to their balances when they upgrade/downgrade or request refunds.

The New Stack: Platforms Powering Automated Blockchain Subscription Refunds

A new ecosystem of tools is emerging to make automation accessible even for non-developers. Platforms like Autopay Pro, MoneyHash, Calypso Finance, and Inqud offer plug-and-play modules for recurring payments and instant refund processing in crypto environments. These platforms allow businesses to configure custom workflows that connect payment rails with internal tools, streamlining operations while maintaining compliance with transparent protocols.

For SaaS providers and decentralized platforms, this shift toward automation is not just about reducing friction. It fundamentally changes how customer relationships are managed. With automated blockchain subscription refunds and onchain plan adjustments, users can trust that their financial interactions are governed by code, not by opaque policies or slow support queues. This is particularly valuable in scenarios where customers expect immediate resolution, such as downgrading a plan mid-cycle or requesting a crypto prorated refund for unused service time.

Implementing Automated Refunds: Best Practices and Considerations

To maximize the benefits of onchain automation, platforms must carefully design refund and adjustment logic within their smart contracts. Here are several best practices to ensure robust, user-friendly systems:

Best Practices for Automating Refunds & Proration

-

Leverage Smart Contracts for Refund Logic: Utilize smart contracts (such as those on Ethereum) to automate refund and proration calculations. Code refund logic directly into the contract to ensure refunds for unused subscription periods are processed transparently and without manual intervention.

-

Implement Standards Like ERC-1337 for Recurring Payments: Adopt standards such as ERC-1337 for recurring subscriptions, which are designed to handle automated billing and refund scenarios on blockchain networks. This promotes interoperability and reliability across platforms.

-

Automate Refund Processing with Specialized Platforms: Integrate with platforms like Autopay Pro or Calypso Finance to automate payment distribution and refund processing, reducing processing times and minimizing errors.

-

Ensure Transparent and Immutable Transaction Records: Use blockchain’s inherent transparency to provide users with clear, immutable records of all refunds and proration adjustments. This builds trust and allows for easy auditing of financial operations.

-

Integrate Automation Tools for Workflow Orchestration: Employ tools like MoneyHash to connect payment systems, automate refund workflows, and unify data across your subscription platform for seamless operations.

-

Adopt Non-Custodial Refund Protocols for Security: Utilize non-custodial refund solutions, such as Circle’s Refund Protocol, to enable secure, smart contract-based dispute resolution and refunds without requiring platform custody of funds.

Clear Proration Algorithms: Define explicit rules for how refunds and credits are calculated during upgrades, downgrades, or cancellations. For example, refunding the exact crypto value for unused days in a monthly or annual plan.

User-Initiated Workflows: Empower users to trigger their own refund requests or plan changes via simple UI actions, which then interact directly with the underlying smart contract logic.

Transparent Onchain Records: Ensure every adjustment, whether a refund or credit, is logged immutably on the blockchain, providing an audit trail that can be reviewed by both business operators and customers.

Security Reviews: Since smart contracts are immutable once deployed, rigorous auditing is essential to prevent exploits or unintended behaviors in financial logic.

The User Experience: From Pain Point to Value Proposition

The legacy approach to subscription adjustments, waiting days for manual review or support tickets, has always been a source of user frustration. Blockchain automation flips this script. The ability to process refunds in under 30 seconds (see Tweave Tech’s case study) sets new expectations for responsiveness across the industry.

This immediacy doesn’t just improve satisfaction, it reduces churn by building trust. Users know they can experiment with different service tiers without financial penalty or bureaucratic delay. For businesses, it means less time spent on support and reconciliation, freeing up resources to focus on product development and growth.

Looking Forward: The Future of Subscription Management Is Onchain

The convergence of smart contract technology with recurring billing models is ushering in a new era of automated financial operations. As standards mature and platforms like Autopay Pro, MoneyHash, Calypso Finance, and Inqud continue to innovate (Autopay Pro, MoneyHash, Calypso Finance, Inqud), we can expect even more sophisticated tools for handling complex billing cycles, without sacrificing transparency or speed.

The end result is a win-win: businesses enjoy streamlined operations and reduced risk of error; customers gain confidence that every adjustment is fair, instant, and verifiable onchain. As user expectations continue to rise across digital services, embracing automated refunds and adjustments will be key to staying competitive, and trusted, in the blockchain subscription economy.