Solana’s ecosystem is exploding in 2026, with dApps raking in over $146 million in revenue last January alone, outpacing every Layer 1 and Layer 2 chain. At a current price of $80.22, Binance-Peg SOL underscores the network’s maturity for sophisticated financial primitives like prorated onchain subscriptions. Developers, imagine embedding solana onchain subscriptions directly into your dApps, where users pay precisely for their usage slice, no offchain hacks required. This isn’t hype; it’s the blueprint for scalable, transparent onchain billing solana dapps demand.

Solana’s blistering throughput, clocking thousands of TPS at sub-cent fees, obliterates the bottlenecks plaguing EVM chains for prorated recurring payments solana. Proration here means dynamic adjustments: a user subscribes mid-cycle, pays pro-rata, upgrades tiers seamlessly. No more clunky cron jobs or centralized relayers. With token delegation and program-derived addresses (PDAs), Solana Programs enforce these rules atomically, turning subscriptions into first-class blockchain citizens.

Solana’s Account Model Unlocks True Subscription Autonomy

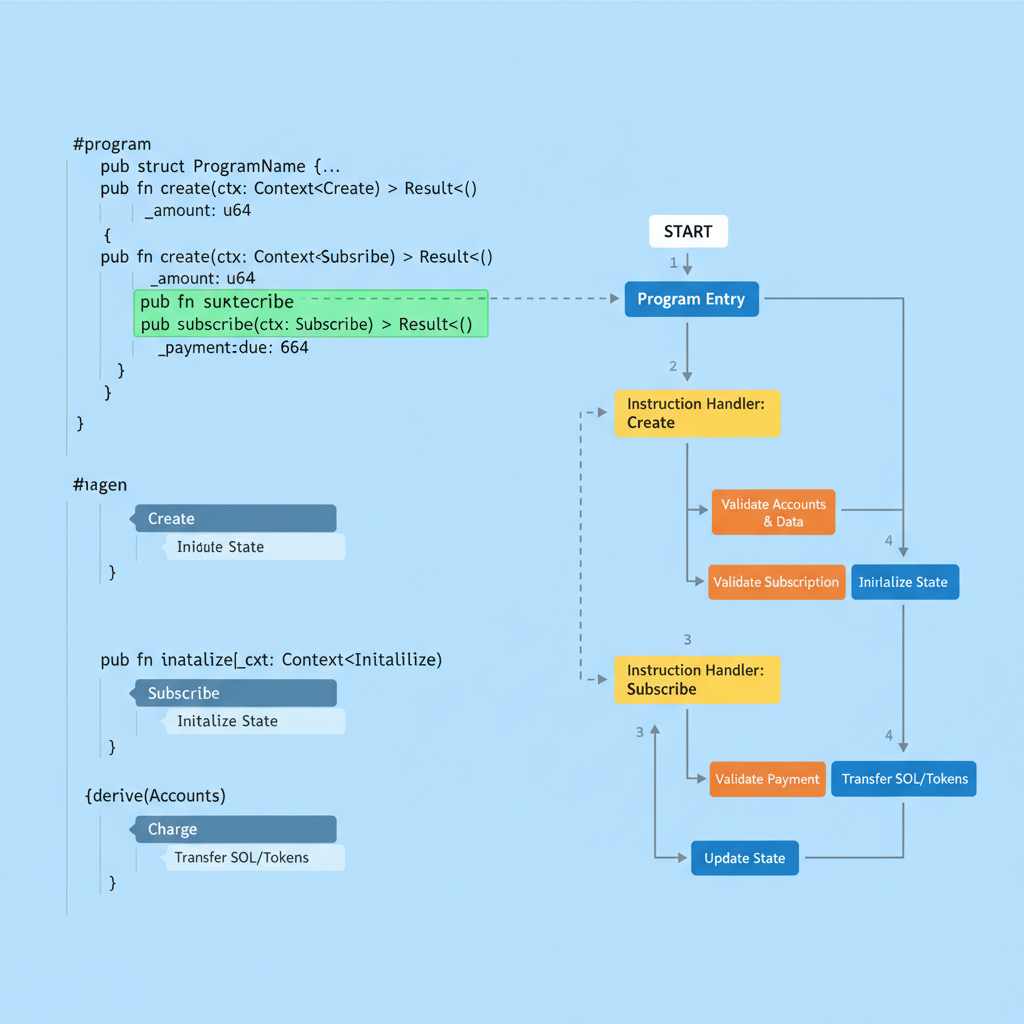

At Solana’s core lies its account-centric model, a departure from EVM’s storage-heavy contracts. Every subscription state, start date, tier, proration factor, lives in a dedicated account, queryable and updatable in parallel. Transactions bundle instructions: one authorizes delegation, another computes owed tokens via CPI (cross-program invocation), settling instantly. This setup sidesteps the ‘recurring payment problem’ devs have griped about on Solana Stack Exchange and Reddit, where Tributary-like protocols hinted at solutions but lacked proration polish.

Picture a SaaS dApp for AI image generation: users delegate SPL tokens to a subscription PDA. On access, the program checks elapsed time, prorates the fee, say, 17 days into a 30-day cycle yields 57% charge, and transfers via Token-2022 extensions for transfer hooks. Visionary? Absolutely. With Solana’s versioned transactions and durable nonces, dropped tx retries become trivial, as QuickNode and Helius guides detail.

Proration Math: Precision Billing Without Oracles

Solana subscription proration thrives on deterministic computation. Define cycles in seconds (e. g. , 2,628,000 for monthly). For a $10 equivalent monthly sub (0.1247 SOL at $80.22), prorate as (current_timestamp – start_timestamp)/cycle_length * amount. Anchor’s Clock sysvar feeds timestamps; u128 math prevents overflow. Mid-cycle cancel? Refund unearned portion to user wallet. This blockchain recurring billing solana model scales to millions, fueling DeFi dashboards, NFT drops, and gaming economies.

Solana (SOL) Price Prediction 2027-2032

Annual forecasts based on $80.22 baseline in early 2026, driven by dApp revenue growth and onchain subscription innovations

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $75 | $180 | $400 | +125% |

| 2028 | $140 | $360 | $800 | +100% |

| 2029 | $250 | $650 | $1,400 | +81% |

| 2030 | $400 | $1,100 | $2,300 | +69% |

| 2031 | $650 | $1,700 | $3,500 | +55% |

| 2032 | $1,000 | $2,500 | $5,000 | +47% |

Price Prediction Summary

Solana (SOL) is forecasted to see robust growth, with average prices rising from $180 in 2027 to $2,500 by 2032. Minimum prices reflect bearish scenarios like market corrections, while maximums capture bullish adoption surges from prorated onchain subscriptions and dApp dominance.

Key Factors Affecting Solana Price

- Surging dApp revenues over $146M monthly in 2026

- Prorated onchain subscriptions enhancing dApp monetization and UX

- Solana’s high throughput and low fees supporting complex models

- Crypto market cycles with potential bull phases post-2026

- Regulatory developments favoring scalable L1 chains

- Technological upgrades and competition from L2 ecosystems

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

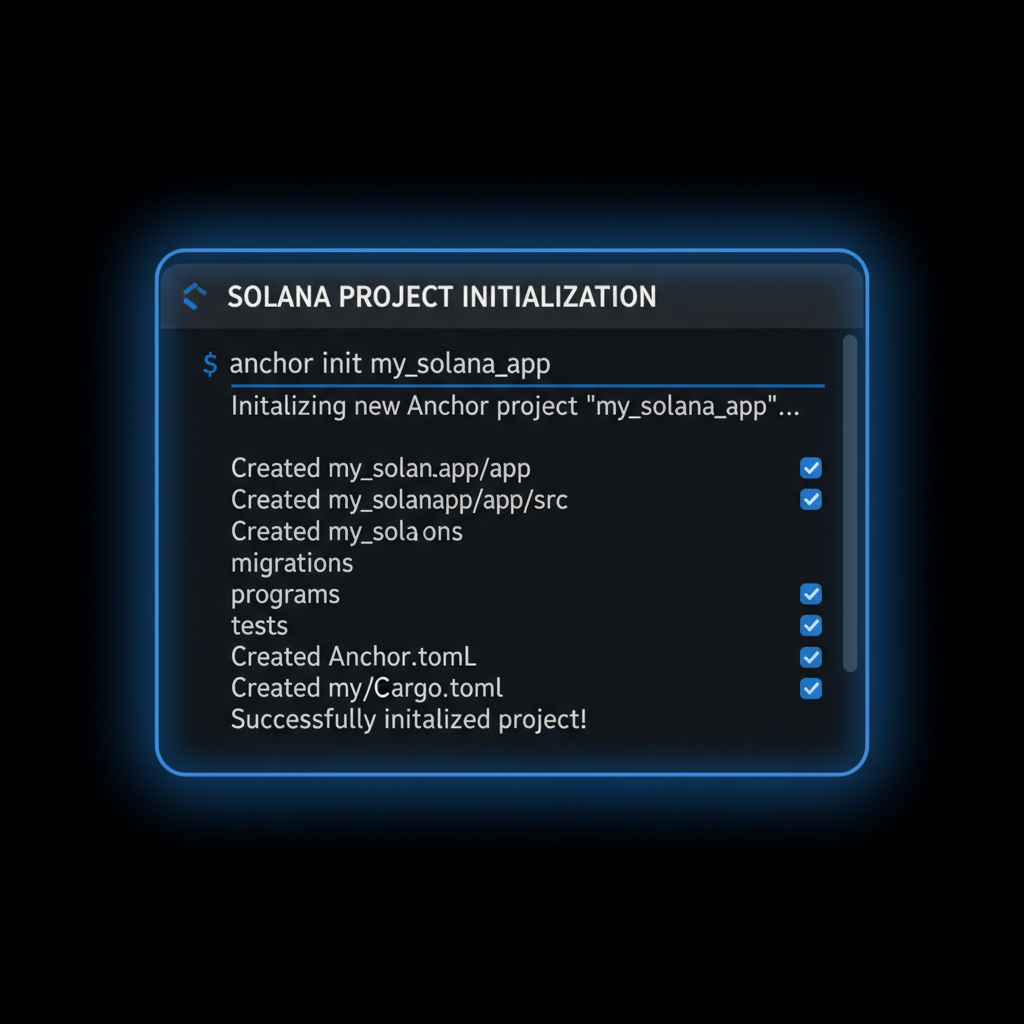

Integrate via SubscribeOnChain. com’s SDK, battle-tested on Base and EVM, now Solana-ready. Initialize a SubscriptionConfig account: set tiers, proration_enabled true, auto-renew via delegate. Frontend hooks wallet approval; backend monitors via WebSocket subscriptions, as QuickNode outlines. No third-party custodians, pure onchain.

Bootstrapping Your dApp with Token Delegation

Token delegation is the linchpin. Users approve a fixed amount to your program’s PDA, revocable anytime. Instructions like ‘top_up’ or ‘prorate_charge’ invoke Token Program transfers, audited and gas-optimized. For onchain recurring subscriptions with proration, start with Anchor framework: derive PDAs from user pubkey and seed “subscription”. Here’s the flow:

- Client: signAndSendTransaction with approve instruction.

- Program: validate delegate authority, compute proration, transfer.

- Post-tx: update state account with new balance and end-date.

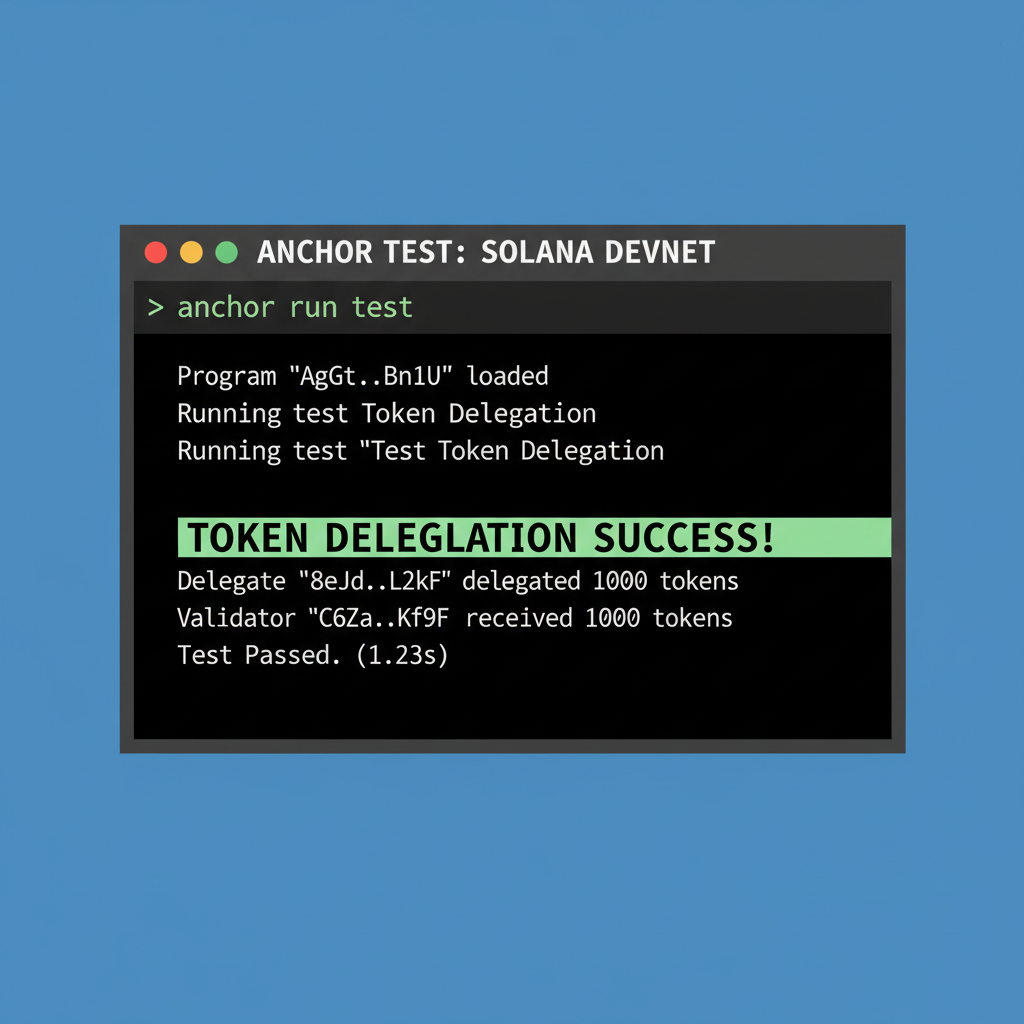

This pattern, refined from Helius’ programming model intros, empowers prorated onchain subscriptions for solana saas. Investors take note: dApps with native billing capture 2-3x LTV versus one-offs. As SOL holds $80.22 amid market dips, now’s the moment to innovate.

Edge cases like mid-cycle upgrades demand nuanced logic: compare new tier cost against prorated old, net settle via CPI. Anchor macros streamline this, generating CPI-safe interfaces. For onchain billing solana dapps, enforce access gates with subscription checks before service instructions, all in one tx bundle.

Solana’s WebSocket subscriptions, as QuickNode documents, keep frontends in sync: listen for account changes on subscription PDAs, trigger UI updates for balance warnings or renewals. No polling waste; real-time solana subscription proration at scale.

Overcoming Recurring Payment Hurdles: Retries and Reliability

Devs on Solana Stack Exchange lament onchain recurrings, but 2026 tools flip the script. Versioned transactions with blockhash callbacks handle drops; preflight simulations catch errors pre-send. Pair with Helius RPCs for priority fees, ensuring 99.9% settlement. Prorated refunds? Deterministic via Clock sysvar diffs, no oracles needed. This reliability cements blockchain recurring billing solana as viable for production SaaS.

SubscribeOnChain. com bridges the gap, its SDK abstracting PDAs, delegations, and proration into composable hooks. Port your Base/EVM subs to Solana in hours: npm install @subscribeonchain/solana, configure tiers, deploy. dApps like AI generators or DeFi vaults now bill dynamically, capturing fractional value. With Binance-Peg SOL steady at $80.22 despite 24h dips, token economics align for growth.

Real-world wins abound. Imagine a content platform: creators set monthly tiers, fans delegate USDC-SPL. Mid-month churn? Instant prorated settle. Gaming guilds auto-renew access passes. Revenue models evolve from one-shots to annuities, mirroring Web2 SaaS but decentralized. Solana’s $146 million January haul proves the canvas; prorated recurring payments solana paints the alpha.

Scaling to Millions: Production Best Practices

Optimize with compute units: batch proration checks, use zero-copy deserialization for account reads. Monitor via Chainstack’s ultimate guide snippets for pastable RPC calls. For high-volume, shard subscriptions across multiple PDAs via user seeds. Security first: restrict delegates to program-owned, audit with Sec3 or OtterSec. This stack delivers prorated onchain subscriptions for Solana SaaS, handling mid-cycle flux flawlessly.

Forward thinkers, integrate now. As Solana cements L1 dominance, dApps forgoing native billing risk commoditization. Token delegation plus proration equals sticky LTV, investor catnip. SOL at $80.22 signals stability; build atop it for the next revenue epoch. Your dApp, armed with these primitives, doesn’t just survive Web3’s churn, it thrives, turning users into perpetual revenue engines.