In the fast-evolving world of Web3 SaaS, handling mid-cycle subscription changes without accurate billing adjustments can erode trust and revenue. Enter onchain proration: a smart contract-driven mechanism that calculates precise charges based on actual usage periods, even when users upgrade, downgrade, or cancel partway through a billing cycle. This isn’t just a technical fix; it’s a strategic advantage for platforms leveraging blockchain’s immutability to deliver transparent, fair web3 saas billing.

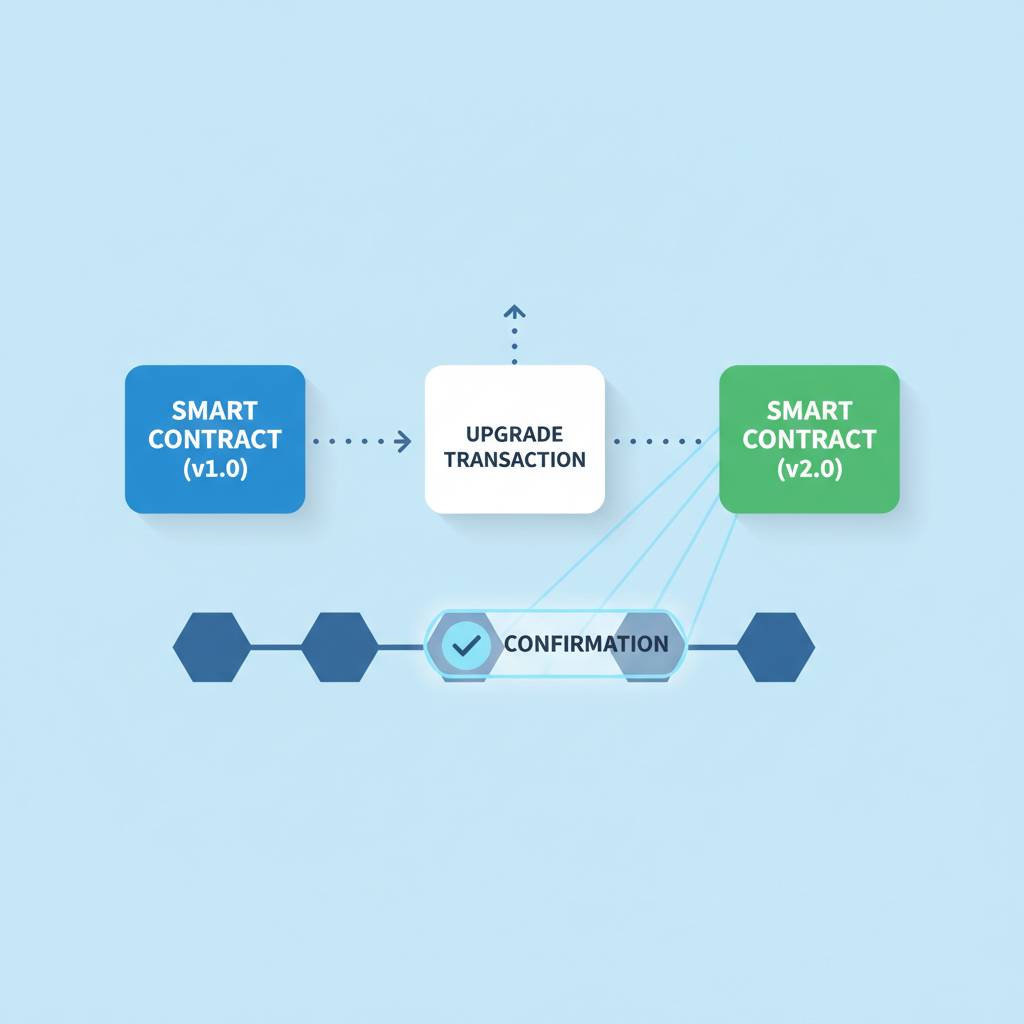

Traditional SaaS billing often relies on offchain processors like Stripe, which approximate proration and leave room for disputes. Onchain approaches, powered by protocols like Superfluid or Request Network, execute these calculations directly on the blockchain. Customers authorize payments once, and smart contracts handle the rest, prorating fees in real-time for recurring subscriptions blockchain setups. Platforms such as SubscribeOnChain. com make this accessible, turning complex logic into plug-and-play solutions for developers.

Decoding Onchain Proration Mechanics

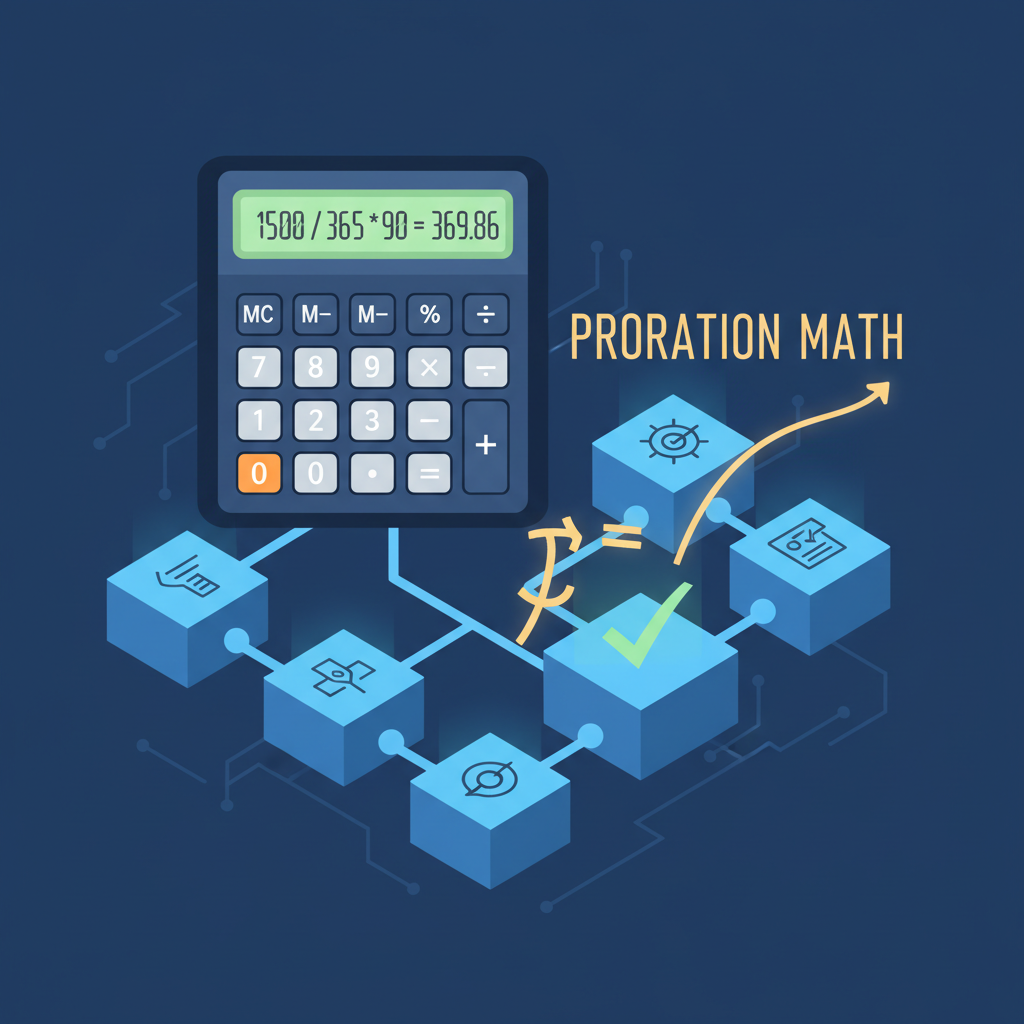

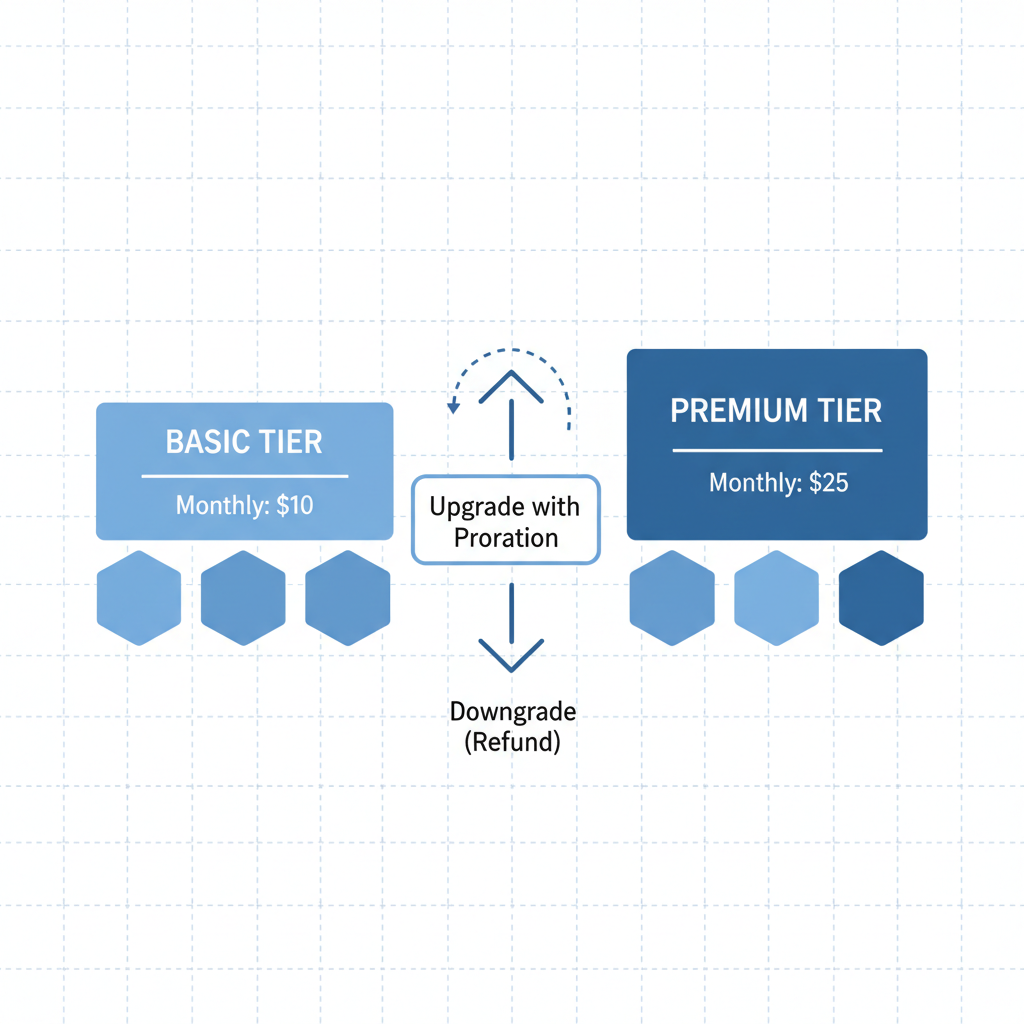

At its core, onchain subscription proration prorates based on time elapsed versus total cycle length. Say a monthly subscription costs 10 USDC, and a user upgrades on day 15. The contract refunds or credits the unused 15 days while charging the pro-rated new tier immediately. This precision stems from blockchain timestamps and atomic transactions, eliminating human error or delayed reconciliations.

Consider a developer building a decentralized analytics tool. Without proration, a user pausing access mid-month still pays full price, breeding resentment. With it, they pay only for consumed value, boosting retention. Sources like Onchainpay highlight how recurring payments in Web3 authorize variable amounts at set intervals, but proration adds the fairness layer missing in many crypto setups.

Strategic Edge of Blockchain Recurring Payments Proration

Why prioritize this now? Web3 SaaS faces unique pressures: volatile token values, global users expecting instant adjustments, and competition from AI-driven billing layers splitting monetization from payments, as noted in recent Stripe critiques. Onchain proration aligns with blockchain’s ethos of verifiability; every adjustment is auditable onchain, reducing chargebacks to near zero.

For SaaS providers, it means predictable revenue without overcharging, which studies from withorb. com show improves lifetime value. Copperx integrations with Superfluid enable real-time notifications for payment events, letting businesses react swiftly to failures. In 2025 and beyond, as per SubscribeOnChain guides, this becomes table stakes for scaling web3 saas billing.

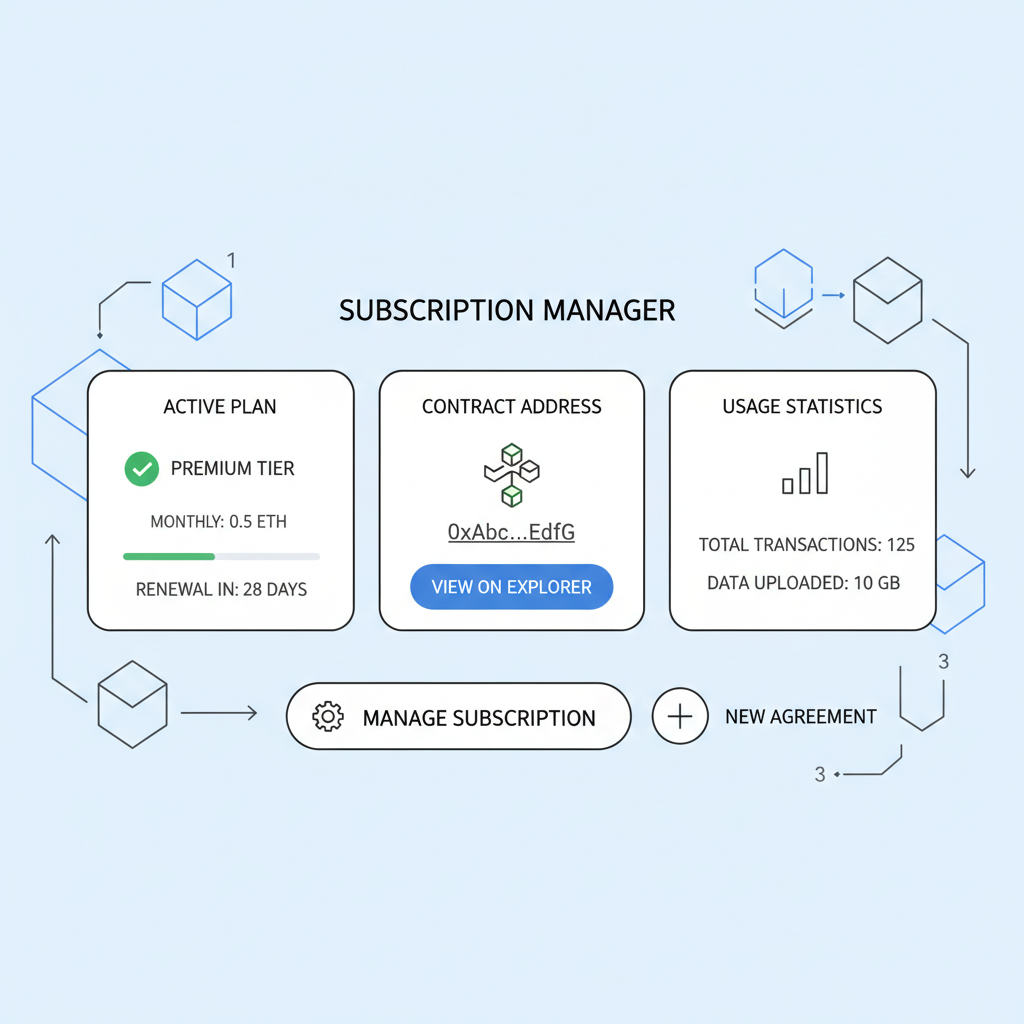

Implementation starts simple. Link a wallet to your smart contract via platforms like Base for low-cost subscriptions. Automate invoicing with dynamic schedules, ensuring proration triggers on events like plan changes. PayPro Global’s eight-step SaaS billing framework adapts well here, emphasizing timely invoice generation tailored to crypto cycles.

Building Your First Onchain Prorated Subscription

Let’s get practical. Begin by choosing a framework supporting ERC-20 or stablecoin streams. SubscribeOnChain. com offers APIs for customizable recurring payments, complete with proration logic. Deploy a contract that tracks start/end times, computes ratios, and settles via batch transactions for gas efficiency.

Real-world adoption, like ForumPay’s crypto subscription guides, shows 73% smoother onboarding with these tools. Niora’s 2025 subscription management trends underscore automation’s role in retention, where proration directly contributes by fostering equity.

That equity translates to measurable gains. Businesses using proration see up to 20% higher renewal rates, as customers appreciate billing that mirrors their actual engagement. Yet, diving deeper reveals nuances in execution that separate reliable systems from fragile ones.

Navigating Gas Fees and Edge Cases in Blockchain Recurring Payments Proration

Gas optimization is non-negotiable. Naive proration contracts can spike costs during high network congestion, eating into margins on low-tier plans. Smart designs batch adjustments or use Layer 2 like Base, where recurring subscriptions blockchain thrive with sub-cent fees. Edge cases, such as leap years or timezone variances, demand robust timestamping via Chainlink oracles for precision.

I’ve traded across volatile assets; the lesson applies here: anticipate failures. What if a user’s wallet drains mid-stream? Protocols like Superfluid’s streaming payments pause gracefully, prorating residuals without overdraws. Copperx dashboards shine here, surfacing real-time alerts so you intervene before churn hits.

Comparison of Onchain Proration Platforms

| Platform | Key Features | Gas Costs | Proration Accuracy | Integrations |

|---|---|---|---|---|

| SubscribeOnChain | Onchain proration for recurring subscriptions, billing automation, crypto payment integration ✅ | Low (~20k-50k gas per adjustment) | Precise to the second | SaaS platforms, Web3 wallets, onchain payment processors |

| Superfluid | Streaming payments for continuous proration, real-time notifications via integrations like Copperx | Very Low (~5k-15k gas for stream updates) | Continuous (sub-second granularity) | DeFi protocols, Copperx, Base Pay Subscriptions |

| Request Network | Customizable recurring payment schedules, APIs for automation, real-time payment notifications | Medium (~50k-150k gas per invoice/payment) | Cycle-based with adjustments | Payment gateways, subscription dashboards, Web3 SaaS tools |

Request Network’s APIs stand out for flexibility, letting you craft variable schedules post-authorization. Pair it with dynamic invoicing, and you’ve got a system that scales from indie creators to enterprise Web3 SaaS. This isn’t theoretical; it’s battle-tested for onchain subscription proration.

Scaling with Integrations and Analytics

Once deployed, layer on analytics. Track proration events onchain to refine pricing tiers, spotting patterns like frequent downgrades signaling feature gaps. Tools from Niora emphasize compliance in subscription management, where automated audits via blockchain explorers keep you ahead of regs.

Integrate with frontends using WalletConnect for seamless upgrades. Users trigger changes via dApp interfaces, contracts compute instantly: prorated credit to new plan, no manual offsets. For variable usage, like compute-heavy SaaS, blend time-based with metered proration, charging per API call fractionally settled at cycle end.

Opinion: Skip this, and you’re leaving revenue on the table. Traditional setups lag in crypto’s speed; blockchain recurring payments proration future-proofs against AI billing shifts, as Stripe watchers predict. Platforms automating this, per 2025 guides, report 30% faster growth.

Forward-thinking teams experiment now. Start with a pilot cohort, measure delta in disputes and LTV. Web3 Enabler’s crypto subscription blueprint aligns perfectly: authorize, automate, prorate. As volatility tempers, stablecoin dominance grows, making these streams reliable cashflow engines.

Platforms evolve fast. Base Pay Subscriptions simplify entry, while custom contracts unlock edges like yield-bearing proration credits. The result? Frictionless web3 saas billing that retains users through transparency, positioning your SaaS as the decentralized leader in a crowded field.