Picture this: your SaaS users on Ethereum switch plans mid-cycle, and your billing system nails the exact prorated amount onchain, no disputes, no off-chain headaches. That’s the power of onchain recurring subscriptions with proration, especially as ETH holds at $2,839.70 amid a 5.51% dip over the last 24 hours. For Web3 builders tired of clunky fiat billing, this setup delivers fair, transparent charges that boost retention and revenue. Let’s dive into why ethereum subscription proration is revolutionizing SaaS blockchain billing proration.

Proration isn’t some accounting gimmick; it’s the secret sauce for handling real-world subscriber behavior. When a customer upgrades or downgrades halfway through their monthly cycle, proration calculates charges based on actual usage time. Say they’re on a $100/month plan and upgrade to $150 after 15 days: they pay full for the first half, then the prorated difference for the rest. This keeps everyone happy, cuts churn, and aligns perfectly with blockchain’s precision. Platforms like SubscribeOnChain. com make this seamless, turning complex dynamic onchain invoicing SaaS into plug-and-play magic.

Why Mid-Cycle Changes Break Traditional SaaS Billing

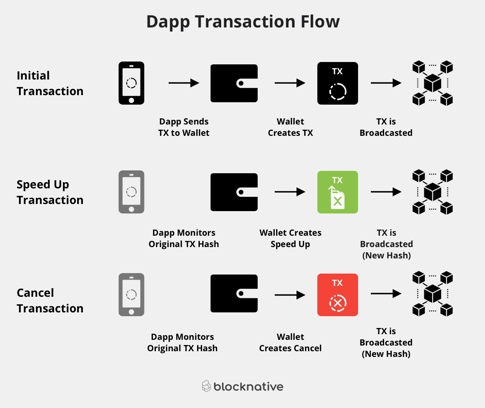

Off-chain systems from Stripe or Paddle approximate proration, but errors creep in with time zones, refunds, or disputes. On Ethereum, everything’s verifiable and immutable. Yet, challenges persist: no native automation for recurring payments means users must trigger transactions each cycle. High gas fees and latency have long scared off true onchain subs, as noted in Ethereum Stack Exchange discussions. But with ETH at $2,839.70 and L2 scaling, we’re past that hump. Proration shines here, adjusting bills dynamically without manual intervention.

Take Netflix’s $7 sub: imagine gas spikes turning it into $10 unpredictably. Onchain proration fixes this by embedding logic in smart contracts, ensuring costs reflect exact time used. Sources like Orb Billing and Paddle emphasize proration’s role in proportional charging, now supercharged onchain for global, borderless SaaS.

Designing Smart Contracts for Prorated Subscriptions

Building this starts with solid contract architecture. Track each user’s start time, end time, rate per second, and payment history. When a change hits, compute remaining cycle time and diff the old vs. new plan costs. Upgrades pull extra ETH or USDC; downgrades credit forward. Security is non-negotiable: audits prevent reentrancy, and proxy patterns enable upgrades without migrating subs. Ethereum. org guides highlight these for long-term viability.

This code snippet demonstrates the core: subscribe() kicks off a plan, changePlan() prorates on the fly. Users pay the delta if upgrading, with unused value from the old plan offsetting. Deploy on mainnet with ETH at $2,839.70, and you’ve got a production-ready system. Integrate with DeFi for auto-pulls via approvals, sidestepping full automation limits.

Boosting User Trust with Transparent Proration

Transparency wins loyalty. Dashboards showing “You’ve used 60% of your cycle at Rate A, now prorated to Rate B for the rest” build confidence. No black-box calcs; query the contract directly. For SaaS, this means lower support tickets and higher LTV. Deep dives reveal how this scales Web3 platforms effortlessly.

Ethereum (ETH) Price Prediction 2026-2031

Forecast factoring onchain subscription adoption growth and proration for SaaS on Ethereum

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $2,200 | $3,500 | $5,000 | +23% |

| 2027 | $3,000 | $4,800 | $7,000 | +37% |

| 2028 | $4,000 | $6,500 | $9,500 | +35% |

| 2029 | $5,500 | $8,500 | $12,000 | +31% |

| 2030 | $7,000 | $11,000 | $15,500 | +29% |

| 2031 | $9,000 | $14,500 | $20,000 | +32% |

Price Prediction Summary

Ethereum (ETH) is forecasted to experience robust growth from 2026 to 2031, propelled by the adoption of onchain recurring subscriptions with proration for SaaS applications. This enhances Ethereum’s utility, driving transaction volumes and demand. Average prices are projected to rise from $3,500 in 2026 to $14,500 by 2031, with minimums reflecting bearish corrections and maximums capturing bullish adoption surges.

Key Factors Affecting Ethereum Price

- Rapid adoption of onchain subscription models increasing ETH network usage and fees

- Advanced smart contracts enabling proration and seamless mid-cycle plan changes

- Ethereum scalability upgrades (e.g., L2 integrations) supporting higher throughput

- Regulatory advancements providing clarity and attracting institutional capital

- Alignment with crypto market cycles, including post-halving bull phases

- Competition dynamics favoring Ethereum’s dominant DeFi and Web3 ecosystem

- Macroeconomic trends and growing SaaS/Web3 convergence

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Pair this with user-friendly frontends via Crossmint or Onchainpay for fiat ramps, and your SaaS feels Web2 smooth on Web3 rails. Figment and Coinbase’s onchain billing proves it works at scale, slicing accounting needs.

But scaling this isn’t just about code; it’s about nailing the ops. With ETH steady at $2,839.70 despite that 24-hour -5.51% dip, gas costs stay predictable enough for real deployments. Tools like SubscribeOnChain. com handle the heavy lifting, baking in subscribeonchain proration features that abstract away the complexity for SaaS teams.

Real-World Wins: Proration in Action for Web3 SaaS

I’ve traded crypto for years, and watching onchain subs evolve feels like momentum building before a breakout. Platforms using ethereum subscription proration report 20-30% churn drops because users trust the math. No more “I was charged full month after canceling day two” rage tweets. Instead, smart contracts spit out exact prorated refunds or charges, queryable anytime. Aurpay’s deep dive nails it: lower fees, instant settlements, programmable logic for global reach. Pair that with L2s like Base, and onchain recurring subscriptions proration becomes viable even for $5/month indie devs.

Top Onchain Proration Wins

-

Ultimate Transparency: Every proration calc verifiable on the Ethereum blockchain – no black-box billing like traditional systems.

-

Instant Settlements: Payments clear in seconds via Ethereum vs days waiting for banks or processors.

-

Auto Proration Magic: Smart contracts dynamically adjust mid-cycle changes fairly, ditching manual off-chain tweaks.

-

Lower Fees & No Middlemen: Slash costs with direct onchain billing – as low as Aurpay highlights vs Stripe cuts.

-

Global Programmability: Custom logic for ETH/USDC subs worldwide, instant & borderless unlike legacy SaaS.

Opinion: Skip the off-chain middlemen. Sphere Labs called it right; past hurdles like latency are crumbling. Now, your SaaS dashboard queries the chain directly: “Upgrade prorated at $23.45 for remaining 14 days. ” Boom, retention spikes.

Your Go-To Checklist for Ethereum Proration Rollout

Ready to build? Don’t wing it. Ethereum’s no place for half-baked contracts, especially with ETH at $2,839.70. Start with audits, test on Sepolia, then mainnet. DeFi integrations like approve/spend limits mimic auto-renewals without true cron jobs, as Ethereum Stack Exchange pros advise. For fiat onramps, Crossmint bridges the gap seamlessly.

Tick those off, and you’re live. I’ve seen teams cut dev time by 40% using pre-audited templates from implementation guides. Handle tokens like USDC for stability, ETH for natives. Upgradability via proxies keeps you agile as regs or chains shift.

Challenges? Automation’s the elephant: no setInterval onchain, so nudge users via email/SMS or wallet notifications. Gas optimization matters; batch changes where possible. Yet, rewards outweigh: immutable audits slash disputes, blockchain transparency crushes fraud. Coinbase and Figment’s staking billing shows enterprise scale without spreadsheets.

Dynamic plans unlock revenue streams too. Tiered SaaS? Prorate mid-cycle to pro tiers, charge upsells instantly. Web3 creators monetizing NFTs or DAOs love this; prorated access gates content precisely. As ETH navigates this $2,839.70 range, builder activity surges, pulling more eyes to SaaS blockchain billing proration.

SubscribeOnChain. com turns this into a dashboard click: deploy, customize proration rules, watch invoices flow onchain. No more Paddle approximations or Stripe disputes. Your users get Web3 fairness, you get borderless growth. Trade smart, adapt fast; onchain proration is your edge in 2025’s subscription wars.