Failed payments are a persistent and expensive headache for SaaS businesses and Web3 creators alike. In the traditional SaaS landscape, involuntary churn from payment failures is alarmingly high, often triggered by issues like expired cards, insufficient funds, or outdated billing information. According to recent reports, the majority of failed payments in SaaS stem from customers simply not having enough funds on their card at the time of billing, a scenario that leads to revenue leakage and user frustration. For Web3 creators, the challenge is compounded by the push-based nature of blockchain transactions, which makes it difficult to automate recurring billing reliably.

Why Traditional Subscription Payments Fail, and Why It Matters

Let’s break down the core reasons behind failed payments in SaaS and Web3:

- Insufficient funds: The most common culprit, as highlighted in recent SaaS payment failure tables, is simply that the customer’s payment method doesn’t have enough money at the time of billing.

- Card expiration and outdated billing details: Cards expire or are replaced, but users don’t always update their information.

- Technical errors and fraud checks: Payment gateways can reject transactions for a variety of reasons, including compliance and risk checks.

These issues translate into lost revenue, increased churn, and a degraded user experience. For businesses, the operational burden of chasing down failed payments is significant, requiring manual intervention, dunning campaigns, and awkward customer conversations. The problem is so acute that entire SaaS tools and guides have emerged to help businesses recover revenue that’s rightfully theirs (Chargebee, SubscriptionFlow).

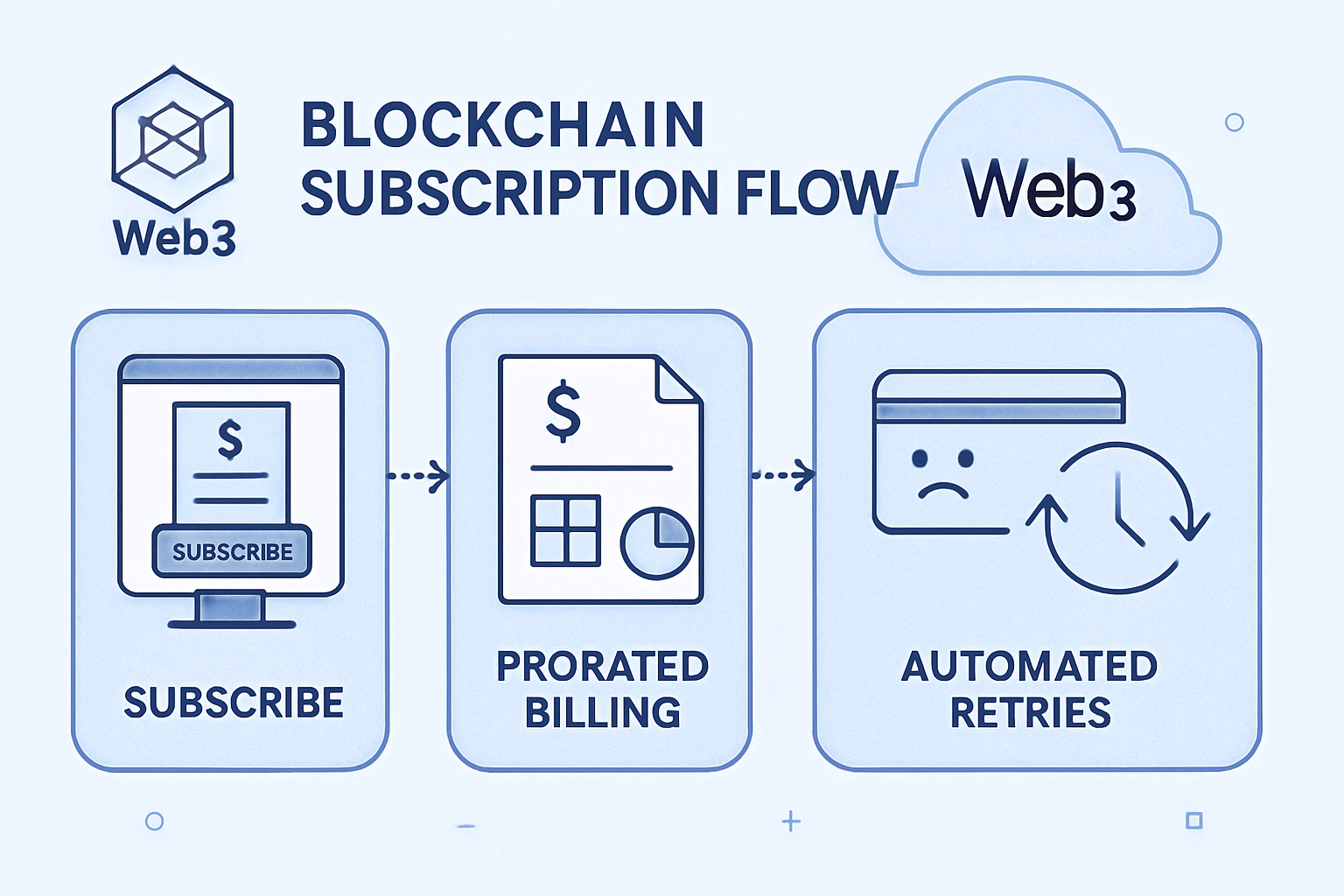

How Onchain Prorated Subscriptions Change the Game

Onchain subscriptions with proration, powered by smart contracts, offer a fundamentally different approach to recurring billing. Instead of relying on centralized payment processors and the inherent limitations of card networks, these systems leverage blockchain’s transparency, automation, and programmability.

Key Benefits of Onchain Prorated Subscriptions

-

Reduced Payment Failures: Onchain subscriptions minimize failed payments by leveraging smart contracts for automated payment retries and grace period management, addressing common issues like insufficient funds or expired cards. (Source: disruptdigi.com)

-

Precise Prorated Billing: Smart contracts enable dynamic, real-time prorated billing for upgrades, downgrades, or pauses, ensuring users are charged only for actual usage without manual adjustments. (Source: subscribeonchain.com)

-

Enhanced Security and Transparency: All subscription transactions are recorded on a tamper-proof blockchain ledger, providing full transparency and reducing disputes over missed charges or cancellations. (Source: disruptdigi.com)

-

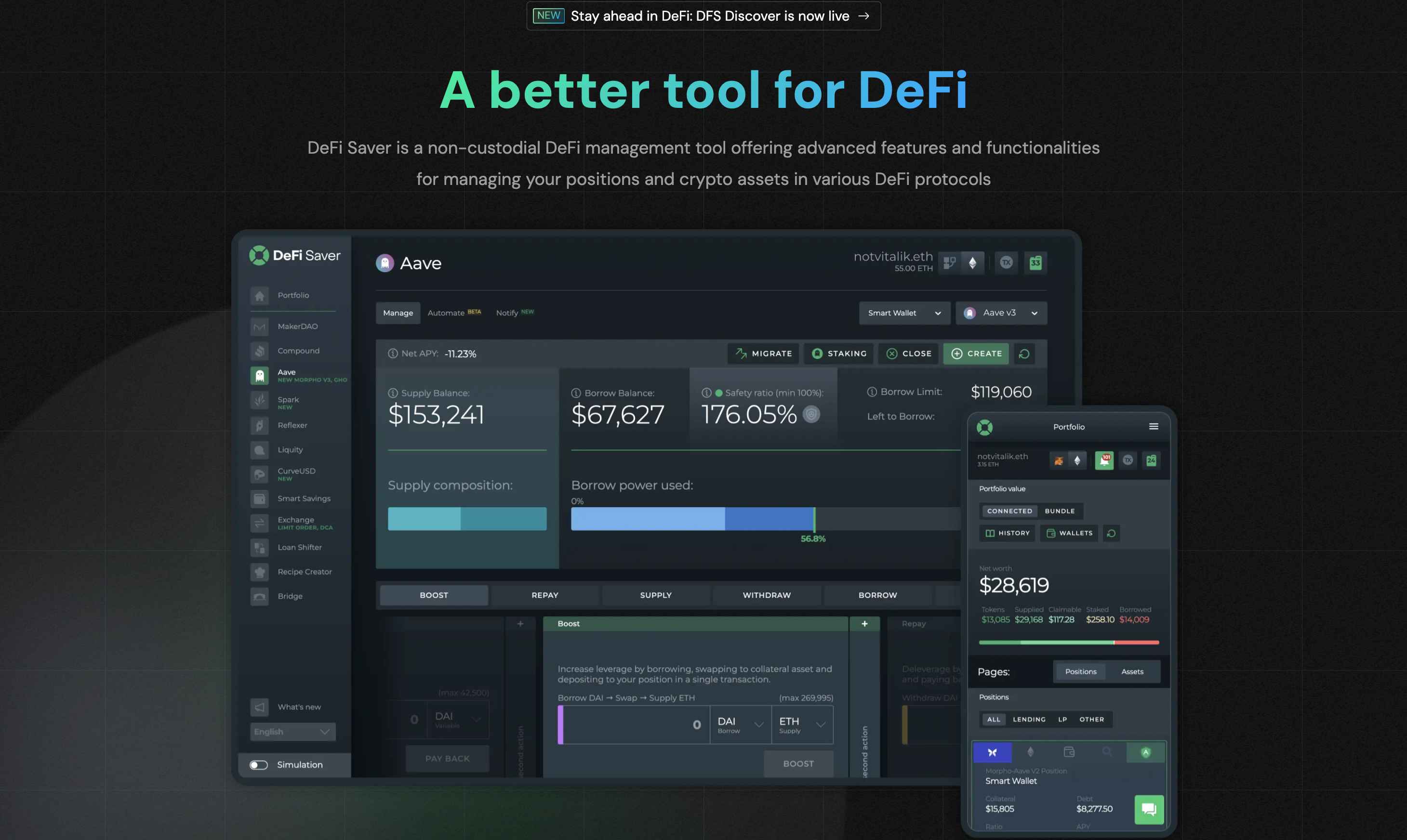

Seamless Integration with DeFi and Tokenization: Onchain subscriptions can integrate with DeFi protocols, allowing features like staking membership tokens for yield while maintaining access rights, enabling innovative rewards and loyalty models. (Source: subscribeonchain.com)

-

Automated Access Control: Smart contracts manage real-time access to services based on payment status, instantly granting or revoking access and reducing manual intervention for SaaS and Web3 creators. (Source: disruptdigi.com)

Here’s how onchain subscriptions solve the failed payment puzzle:

- Grace period management: Smart contracts can enforce automated grace periods, giving users a window to resolve payment issues without immediate service disruption. For example, a 7-day grace period allows a user to top up their crypto wallet and avoid losing access instantly (source).

- Automated payment retries: Instead of requiring manual intervention, smart contracts can retry failed payments at predefined intervals, increasing the chance of successful collection.

- Allowance checks: Before executing a transaction, the contract verifies that the user has approved sufficient funds, reducing failed transactions due to inadequate approvals.

- Prorated billing: Dynamic invoicing means users are only charged for the exact time they use a service, down to the second. This eliminates overcharging and ensures fair, transparent billing when users upgrade, downgrade, or pause their subscriptions (source).

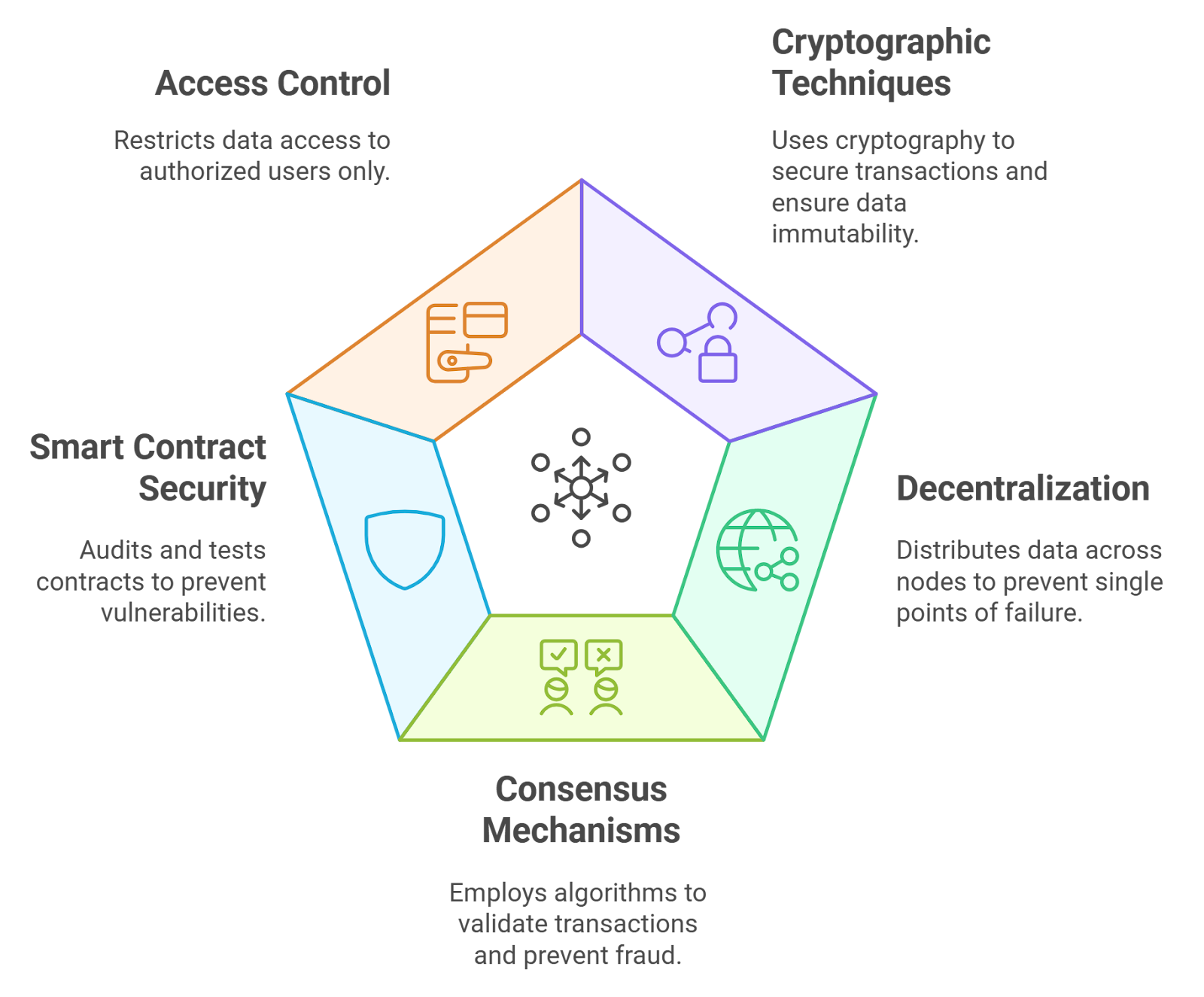

Enhanced Transparency, Security, and User Experience

One of the most powerful advantages of blockchain recurring billing for SaaS is its inherent transparency. Every transaction and subscription event is recorded onchain, creating a tamper-proof ledger that both providers and users can audit. This visibility reduces disputes over missed charges or cancellations and builds trust between parties.

Additionally, decentralized subscription management eliminates single points of failure. If one payment processor goes offline or changes its policies, your subscription business isn’t at risk. The programmable nature of smart contracts means you can build in custom logic for access control, invoicing, or even loyalty rewards, without relying on third-party intermediaries.

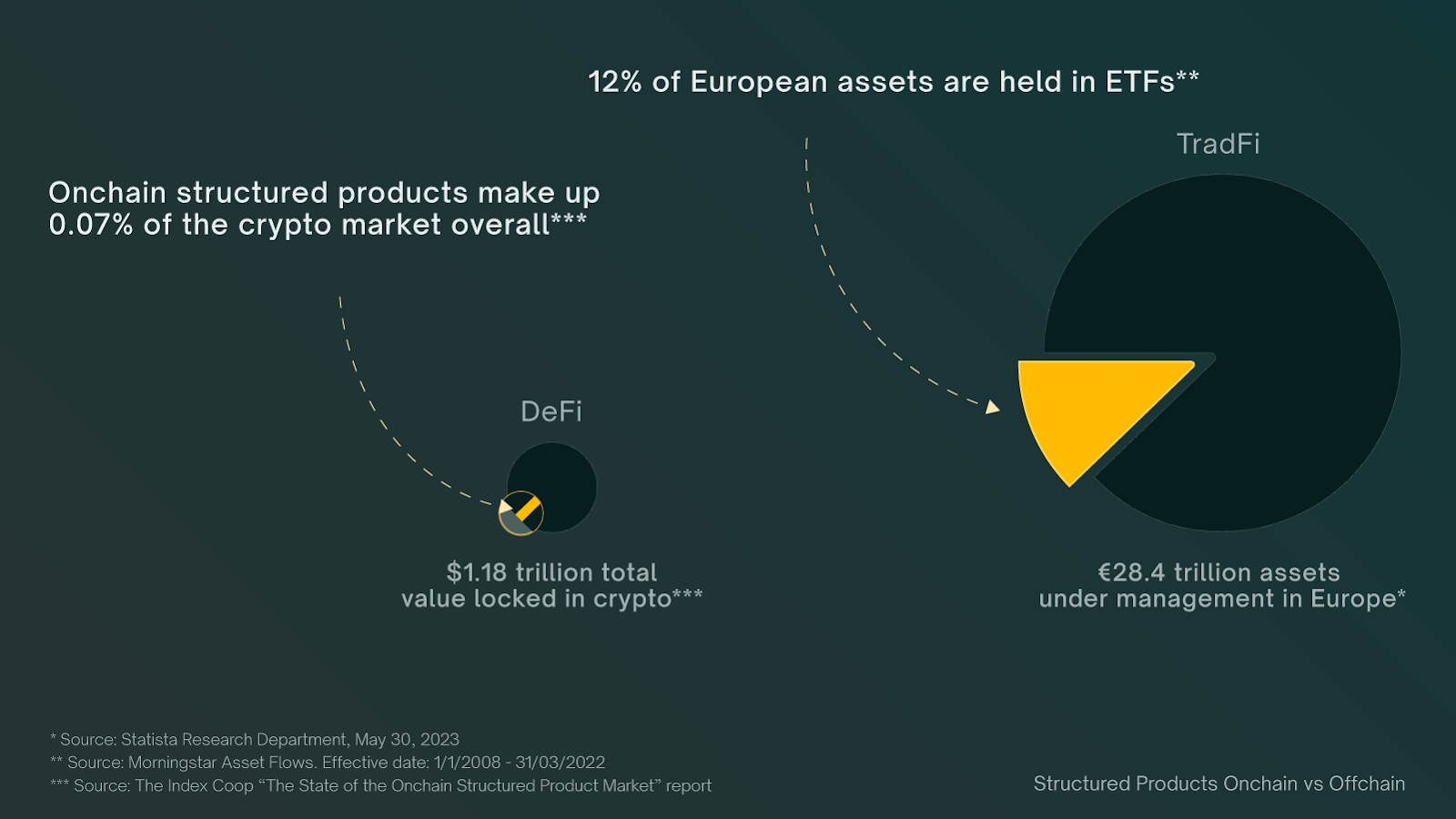

Onchain subscriptions also unlock new business models and revenue streams that simply aren’t possible with legacy systems. For example, by integrating with DeFi protocols, SaaS providers can allow users to stake platform tokens for yield while maintaining access to premium features. This composability is a unique advantage of decentralized subscription management, enabling more flexible and user-centric monetization strategies.

Moreover, the programmability of smart contracts allows for real-time, granular adjustments. If a user upgrades their plan mid-cycle, the contract instantly recalculates the prorated amount owed and updates access permissions accordingly. No more waiting for manual adjustments or risking overcharges, everything happens transparently, onchain, and in real time. This level of automation not only prevents billing disputes but also enhances the overall user experience, making it easier for customers to trust and stick with your service.

Real-World Impact: Lower Churn, Higher Revenue

For SaaS businesses and Web3 creators, the shift to automated crypto billing with proration is more than a technical upgrade, it’s a strategic move to reduce involuntary churn and reclaim lost revenue. By removing the friction of card-based payments and automating retries and grace periods, onchain subscriptions significantly decrease the risk of losing customers to preventable payment failures. This is especially critical as SaaS payment failure rates remain stubbornly high, with some reports noting that over 60% of failed payments are due to insufficient funds alone (Reddit · r/startups).

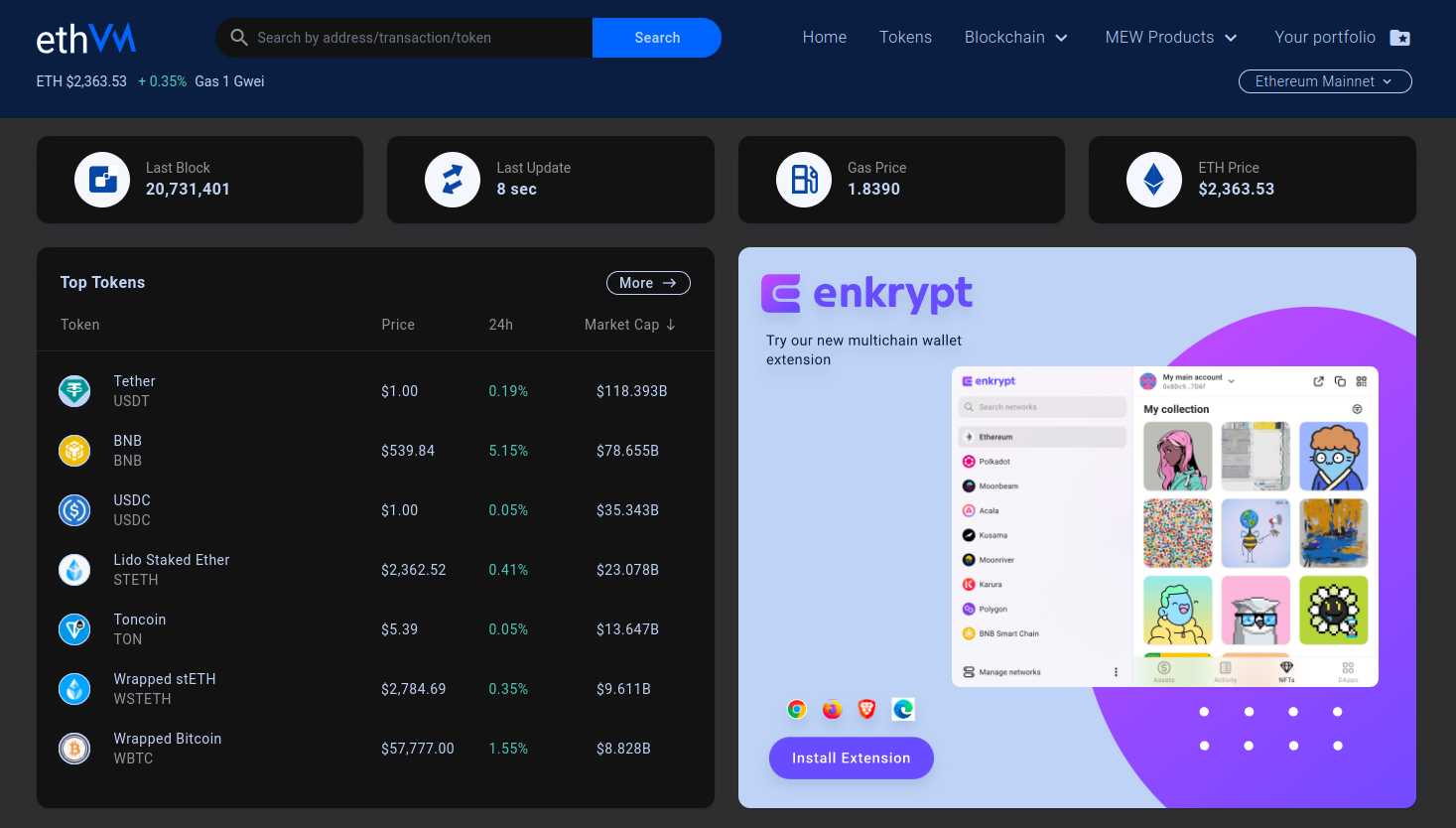

Transparency is another major win. With every subscription event immutably recorded onchain, both providers and users have access to a single source of truth. This not only streamlines accounting and compliance but also makes it easier to integrate with other blockchain-based financial tools, such as automated tax reporting or cross-border invoicing.

How Onchain Prorated Subscriptions Reduce SaaS Payment Failures

-

Automated Payment Retries via Smart Contracts: Onchain subscription platforms like Superfluid use smart contracts to automatically retry failed payments at set intervals. This increases the chance of successful transactions without manual intervention, directly addressing failures from insufficient funds or temporary issues.

-

Grace Periods for Payment Resolution: Solutions such as Unlock Protocol allow for configurable grace periods within their smart contracts. This means users retain access while resolving payment issues, reducing involuntary churn due to short-term payment failures.

-

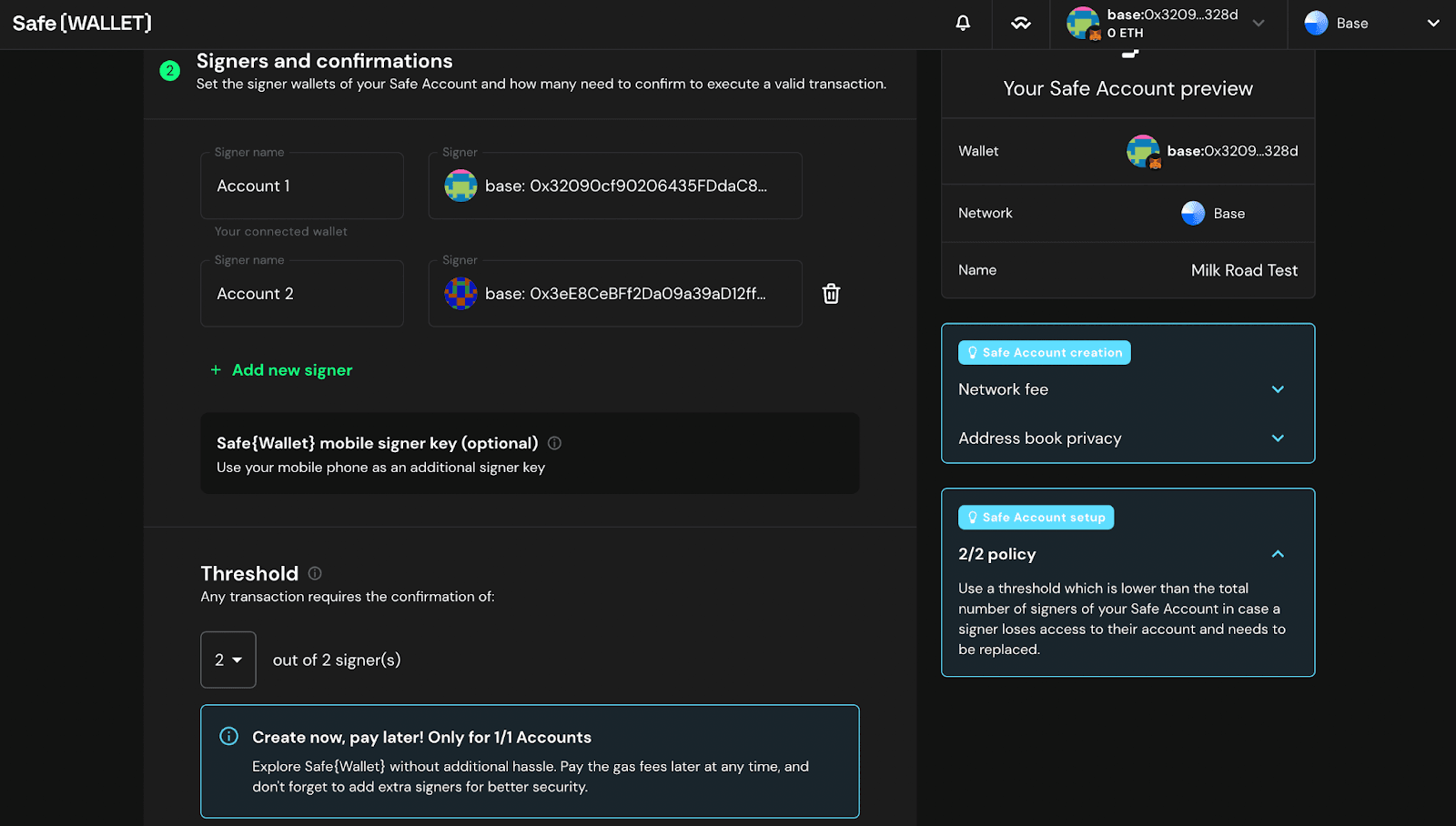

Allowance and Approval Checks Before Billing: Platforms like Gnosis Safe integrate token allowance checks before executing subscription payments. This ensures users have authorized sufficient funds, preventing failed transactions due to inadequate approvals.

-

Precise Prorated Billing for Flexible Plans: Onchain systems such as Sablier enable dynamic, second-by-second billing. This allows for accurate charges when users upgrade, downgrade, or pause their subscriptions, eliminating overbilling and reducing disputes that can lead to failed payments.

-

Transparent and Tamper-Proof Transaction Records: By leveraging public blockchains (e.g., Ethereum), onchain subscriptions provide an auditable, immutable record of all subscription transactions. This transparency reduces confusion over missed payments and supports dispute resolution, further decreasing failed payment incidents.

-

Integration with DeFi for Enhanced Payment Options: Onchain platforms like Aave and Uniswap enable users to manage subscription funds via DeFi protocols, including staking or liquidity provision. This flexibility can help users maintain sufficient balances, reducing failed payments from insufficient funds.

What to Watch: Challenges and the Road Ahead

Despite these advantages, implementing onchain subscriptions isn’t without hurdles. The push-based nature of blockchain payments means user authorization is still required for each transaction, so seamless opt-out models are an ongoing area of innovation (Medium · Gaurang (GT) Torvekar). However, emerging standards and improved wallet integrations are rapidly closing this gap, making decentralized subscription management more viable for mainstream SaaS businesses.

Ultimately, onchain subscriptions with proration are poised to become the gold standard for recurring billing in the SaaS and Web3 economies. They offer a robust answer to the persistent problem of failed payments, while delivering unmatched transparency, flexibility, and composability. As more businesses migrate to blockchain-based systems, expect to see a dramatic reduction in churn and a new era of user-friendly, automated crypto billing.