Recurring payments are the lifeblood of SaaS businesses, yet even the most robust Web2 billing systems struggle with reliability. According to recent market data, 2-6% of SaaS subscribers routinely end up in a “past due” state due to failed payments (Reddit · r/SaaS). These failures are not merely accounting inconveniences; they directly impact cash flow, customer churn, and operational predictability. In the rapidly evolving landscape of Web3 SaaS, onchain recurring subscriptions are emerging as a transformative solution to these persistent challenges.

Why Traditional Recurring Payments Fail: The Numbers and the Friction

The standard model for recurring payments relies on credit cards or centralized payment processors. While convenient at first glance, this approach is riddled with vulnerabilities:

Why Traditional SaaS Recurring Payments Fail

-

High Rate of Payment Failures Due to Expired or Declined CardsTraditional SaaS billing relies on credit and debit cards, which frequently expire or are declined, leading to a 2-6% “past due” rate among subscribers. This results in service interruptions and increased customer churn.

-

Manual Intervention Required for Payment ResolutionWhen payments fail, customers must manually update their billing information or retry payments, causing friction and delays in restoring service access.

-

Complex Retry and Dunning ProcessesTo recover failed payments, SaaS providers implement retry logic and dunning emails, but these processes are not always effective and can annoy users, sometimes leading to cancellations.

-

Signature Fatigue from Repeated Authorization RequestsIn some payment systems, especially in Web3 contexts, users are required to manually approve each transaction, resulting in signature fatigue and a poor user experience.

-

Risk of Involuntary ChurnPayment failures can lead to unintended cancellations, even for customers who want to continue the service, causing involuntary churn and lost revenue for SaaS businesses.

The result? Service interruptions, involuntary churn, and lost revenue. Even advanced retry logic and dunning strategies only partially mitigate these issues (see Chargebee’s guide on failed payments). Furthermore, every failed payment triggers a chain reaction of manual interventions, support tickets, and potential customer frustration.

Signature Fatigue: A Unique Web3 Pain Point

Web3 promised seamless automation but delivered a new kind of friction: signature fatigue. Unlike Web2, where payment credentials are stored and charged automatically, most onchain transactions require users to manually sign every payment using their wallet. This extra step breaks the user experience for subscription-based services:

- Manual approvals: Users must be present to sign each transaction, disastrous for monthly or weekly subscriptions.

- Lapsed access: Missing a signature means instant service interruption.

- User drop-off: The more steps required, the higher the abandonment rate during renewals.

This problem is so prevalent that it has earned its own term in crypto circles: signature fatigue. It is a barrier to mainstream adoption for Web3 SaaS models that rely on automated billing.

The Onchain Subscription Advantage: Automation Without Compromise

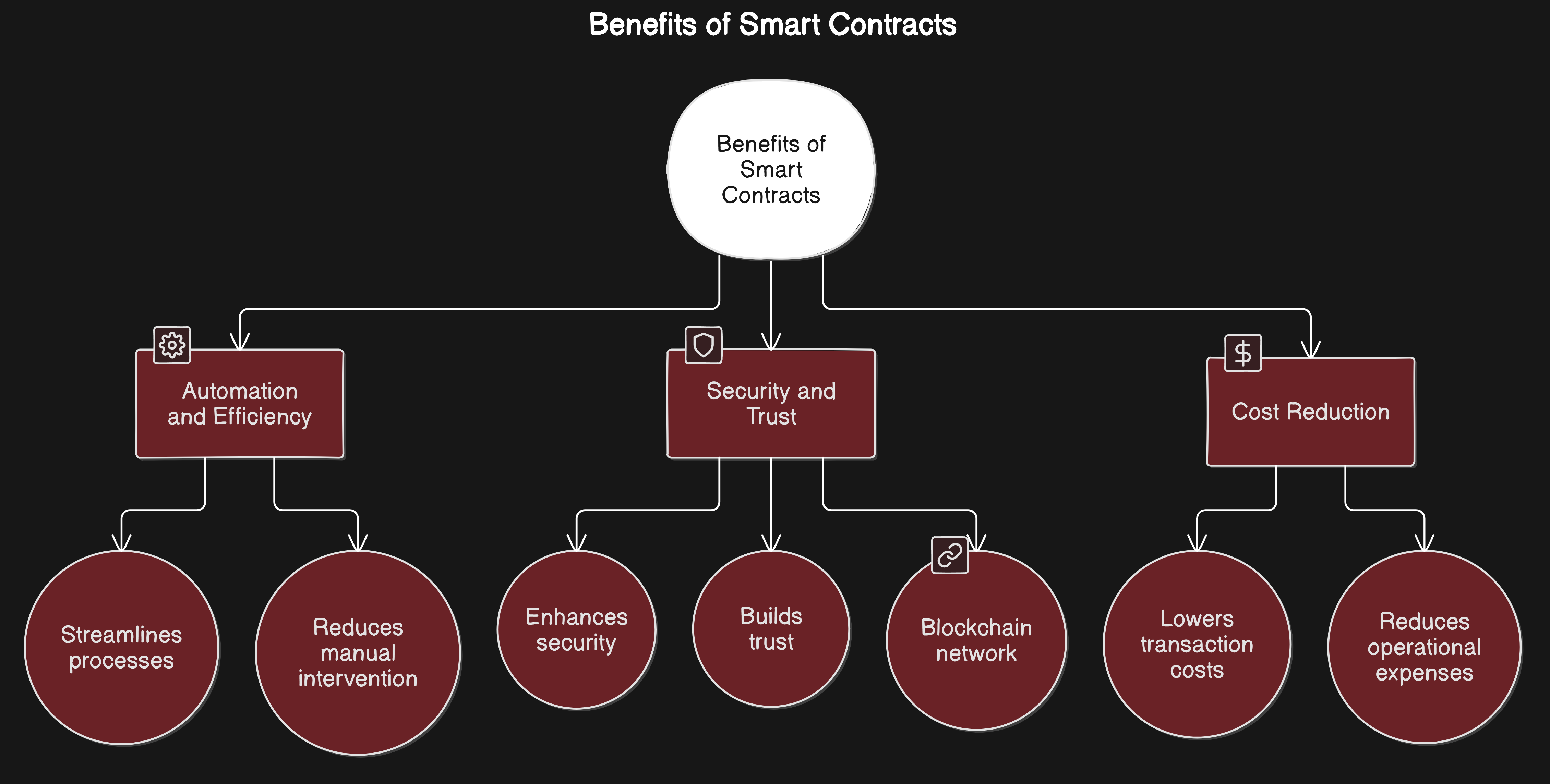

True onchain recurring subscriptions, powered by smart contracts, fundamentally change how subscription billing works in decentralized environments. Instead of relying on off-chain payment rails or repeated user intervention, smart contracts can be programmed to execute recurring transfers at predefined intervals without further signatures after initial consent.

This innovation addresses both root causes of payment failure in SaaS:

- No more card declines: Payments are made directly from non-custodial wallets using stablecoins or native tokens, eliminating expired cards or insufficient funds issues common with fiat rails.

- No more signature fatigue: After an initial authorization (the first signature), ongoing payments are handled autonomously by code, ensuring uninterrupted service access unless explicitly revoked by the user.

Transparency and Proration: New Standards for Fair Billing

The benefits do not stop at reliability. Onchain recurring subscriptions introduce new levels of transparency and flexibility into billing cycles. Every transaction is immutably recorded on-chain; customers can verify charges independently at any time. Advanced features like prorated billing, where users pay only for what they use when upgrading or downgrading plans, are seamlessly implemented via smart contract logic (source).

Prorated billing onchain is not just a technical convenience; it radically improves customer trust and satisfaction. Instead of opaque, retroactive adjustments or confusing partial charges, users see real-time, tamper-proof records of exactly what they are billed for. This level of transparency is almost impossible to achieve with legacy SaaS infrastructure, where billing errors and disputes can drag on for weeks.

Decentralized Subscription Management: Control and Security for Both Sides

With decentralized subscription management, both businesses and customers gain unprecedented control over their financial relationships. Users can audit all invoices and receipts directly onchain, increasing confidence in the integrity of every transaction. Businesses, meanwhile, benefit from predictable cash flow and dramatically lower churn rates since missed payments due to expired cards or lost credentials become a thing of the past.

Key Benefits of Decentralized Subscription Management

-

Automated, Reliable Payments: Onchain recurring subscriptions use smart contracts to automate billing, significantly reducing failed payments due to expired or declined cards. This ensures SaaS businesses maintain steady revenue and users experience uninterrupted service access.

-

Elimination of Signature Fatigue: Platforms like Sablier and Superfluid enable recurring payments without requiring users to manually approve each transaction. This streamlines the payment process and improves user experience by removing repetitive signature requests.

-

Enhanced Transparency: All subscription transactions are immutably recorded on public blockchains such as Ethereum and Polygon. This provides both businesses and users with real-time visibility into payment history and billing status.

-

Increased Security: Decentralized payment processing reduces reliance on centralized payment gateways, minimizing risks of data breaches and fraud. Users retain control over their funds, and businesses benefit from tamper-resistant payment flows.

-

Global Accessibility: Onchain subscriptions are accessible to anyone with a crypto wallet, regardless of location or banking status. This expands the potential user base for SaaS businesses and supports financial inclusion.

The security advantages are equally significant. Onchain recurring subscriptions minimize the attack surface for payment fraud – there is no centralized database of credit cards to breach. Instead, smart contracts execute payments based on pre-agreed logic, with funds moving only when all conditions are met. This model also supports advanced features like programmable refunds or dynamic discounts without manual intervention.

Real-World Impact: Lower Churn, Higher Retention

The impact of moving to an onchain recurring model is quantifiable. By eliminating common payment failure points and signature fatigue, SaaS providers can reduce involuntary churn rates well below the industry average 2-6% “past due” state (Reddit · r/SaaS). Customers enjoy uninterrupted access to services they rely on, without monthly reminders or approval requests that break their workflow.

This paradigm shift also unlocks new monetization strategies for Web3 projects: micro-subscriptions that would be uneconomical with high card processing fees become viable with low-gas blockchain transactions; global reach expands as anyone with a wallet can participate regardless of local banking infrastructure.

“Onchain recurring subscriptions have given us true peace of mind, our revenue is steady, our users are happier, and billing headaches have practically vanished. “

Getting Started: Implementing Onchain Subscriptions in Your Stack

The technical barrier to entry has dropped rapidly thanks to platforms like SubscribeOnChain. com. Integration guides help developers deploy audited smart contracts that handle recurring payments, proration logic, and invoice management out-of-the-box. For SaaS teams used to Stripe or Chargebee workflows, modern onchain tools offer familiar dashboards plus the added benefits of decentralization.

If you’re building a Web3 SaaS product or looking to future-proof your existing offering against failed payments and user friction, consider piloting an onchain subscription model today. The ecosystem is maturing fast, and your customers will thank you for removing barriers between them and the services they love.