Subscription billing is at the heart of today’s digital economy, shaping how SaaS providers, digital creators, and decentralized platforms capture recurring revenue. Yet the mechanics of billing, especially when it comes to proration, are evolving rapidly. Should you stick with traditional SaaS billing or move to onchain prorated subscriptions? Let’s break down the core differences and what they mean for your business.

How Traditional SaaS Billing Handles Proration

Most SaaS companies have long relied on fixed-interval billing: monthly, quarterly, or annual charges that keep revenue predictable. But predictability can come at the cost of flexibility. What happens when a customer upgrades mid-month? Enter prorated billing. In practice, this means charging only for the portion of a service actually used. If a customer moves from a $20/month plan halfway through a 30-day cycle and upgrades after 13 days, they pay just $11.33 for the remaining 17 days ($20/30 days x 17 days), rather than being billed for a full month again. This approach is fairer and improves trust, but it still relies on centralized systems to calculate, invoice, and adjust charges.

“Prorated billing is an invoicing method that adjusts the price a customer pays based on the proportion of the product or service they have used in a billing period. “: Zenskar

The challenge? Even with proration logic in place, manual intervention is often required for edge cases like late cancellations or overlapping upgrades. Human error creeps in. Transparency can be lacking, customers may dispute charges if they don’t see how calculations are made in real time.

Onchain Prorated Subscriptions: Blockchain’s Automated Advantage

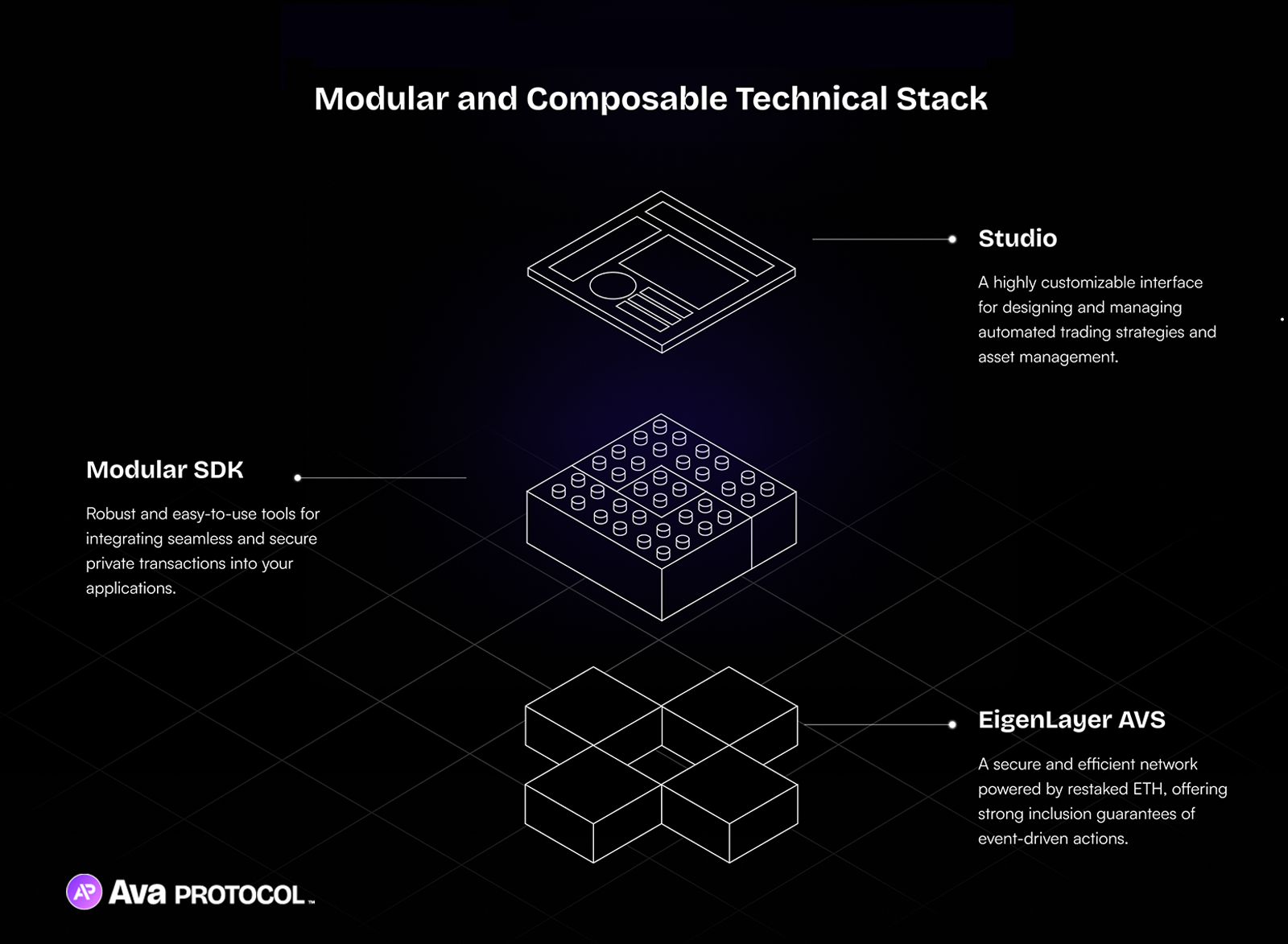

Onchain prorated subscriptions take these pain points and address them head-on using blockchain technology. Here, smart contracts automate every aspect of subscription management, from calculating prorated fees to executing payments and maintaining an immutable ledger of all transactions. No more spreadsheet gymnastics or reconciliation headaches.

This model brings several advantages:

Key Benefits of Onchain Prorated Subscriptions

-

Real-Time Transparency: Onchain prorated subscriptions leverage blockchain’s public ledger, allowing both providers and customers to track billing events in real time. This transparency reduces disputes and builds trust, as every transaction is visible and immutable.

-

Automated Billing with Smart Contracts: By utilizing smart contracts (such as those on Ethereum), onchain subscriptions automate upgrades, downgrades, and cancellations. This eliminates manual intervention, reducing errors and administrative overhead.

-

Enhanced Security: Onchain billing systems are decentralized, minimizing single points of failure and offering cryptographic protection for sensitive data. This makes them less vulnerable to cyberattacks and data breaches compared to traditional SaaS billing platforms.

-

Global Accessibility and Lower Transaction Costs: Onchain subscriptions often utilize stablecoins (e.g., USDC) for payments. This enables borderless transactions and can reduce fees associated with traditional banking systems, making SaaS services more accessible worldwide.

-

Immutable Audit Trail: Every billing action is permanently recorded on the blockchain, providing a tamper-proof audit trail. This is invaluable for compliance, dispute resolution, and financial reporting.

Transparency: Every transaction is visible on-chain, reducing disputes over unclear charges.

Automation: Upgrades, downgrades, cancellations, all handled instantly by code.

Security: Decentralized architecture reduces risks associated with data breaches or single points of failure.

Permanence: Transactions are immutable; historical records can’t be altered retroactively.

“Software as a Service (SaaS) providers can utilize on-chain subscriptions to offer their services in a more transparent and efficient manner. “

A Side-by-Side Look: Pricing Accuracy and Customer Experience

The difference between these two models becomes stark when you consider pricing accuracy and user experience. In traditional setups, proration depends heavily on backend logic and trust that calculations are correct, customers may only see final invoices without understanding interim changes. By contrast, onchain prorated subscriptions expose all calculations live on-chain; anyone can verify exactly how much was charged for each day or feature tier.

This level of transparency isn’t just about fairness, it actively builds loyalty among users who value openness over black-box processes. It also streamlines audits for finance teams who need to reconcile revenue streams quickly and accurately.

For businesses operating globally or serving privacy-conscious clients, the decentralized nature of blockchain-based billing offers an additional layer of confidence. Not only are transactions visible and verifiable by all parties, but sensitive customer data is never stored in a single, breach-prone database. This architectural shift reduces compliance headaches and future-proofs your billing operations against evolving security threats.

Operational Impact and Growth Potential

Adopting onchain prorated subscriptions can also unlock new business models. For example, micro-SaaS tools or content platforms that previously found traditional payment rails too costly or complex can now automate recurring billing with minimal overhead. Stablecoin payments further broaden access to unbanked or international customers, sidestepping high fees and slow settlement times associated with card networks.

The result? Faster go-to-market for innovative services, lower churn thanks to frictionless upgrades and downgrades, and the ability to experiment with usage-based pricing at scale. As fixed subscriptions lose favor due to their inflexibility (see more on proration here), dynamic invoicing via smart contracts becomes a clear competitive edge.

Regulatory readiness remains a consideration. While onchain solutions offer global reach, businesses must carefully assess the legal landscape in their jurisdictions. However, the inherent auditability of blockchain records can simplify compliance reporting compared to opaque legacy systems.

Which Model Is Right for You?

No single approach fits every business. If you operate in highly regulated sectors or need deep integration with existing enterprise software, traditional SaaS billing may still be optimal, at least for now. But if transparency, automation, and security are top priorities, or if you’re building for a digitally native audience, onchain prorated subscriptions deliver significant strategic advantages.

Key Factors for Choosing Blockchain vs. Traditional SaaS Billing

-

Security and Data Integrity: Blockchain-based solutions provide decentralized security and cryptographic protection, reducing single points of failure. Traditional SaaS billing systems depend on centralized infrastructure, making them more vulnerable to targeted attacks.

-

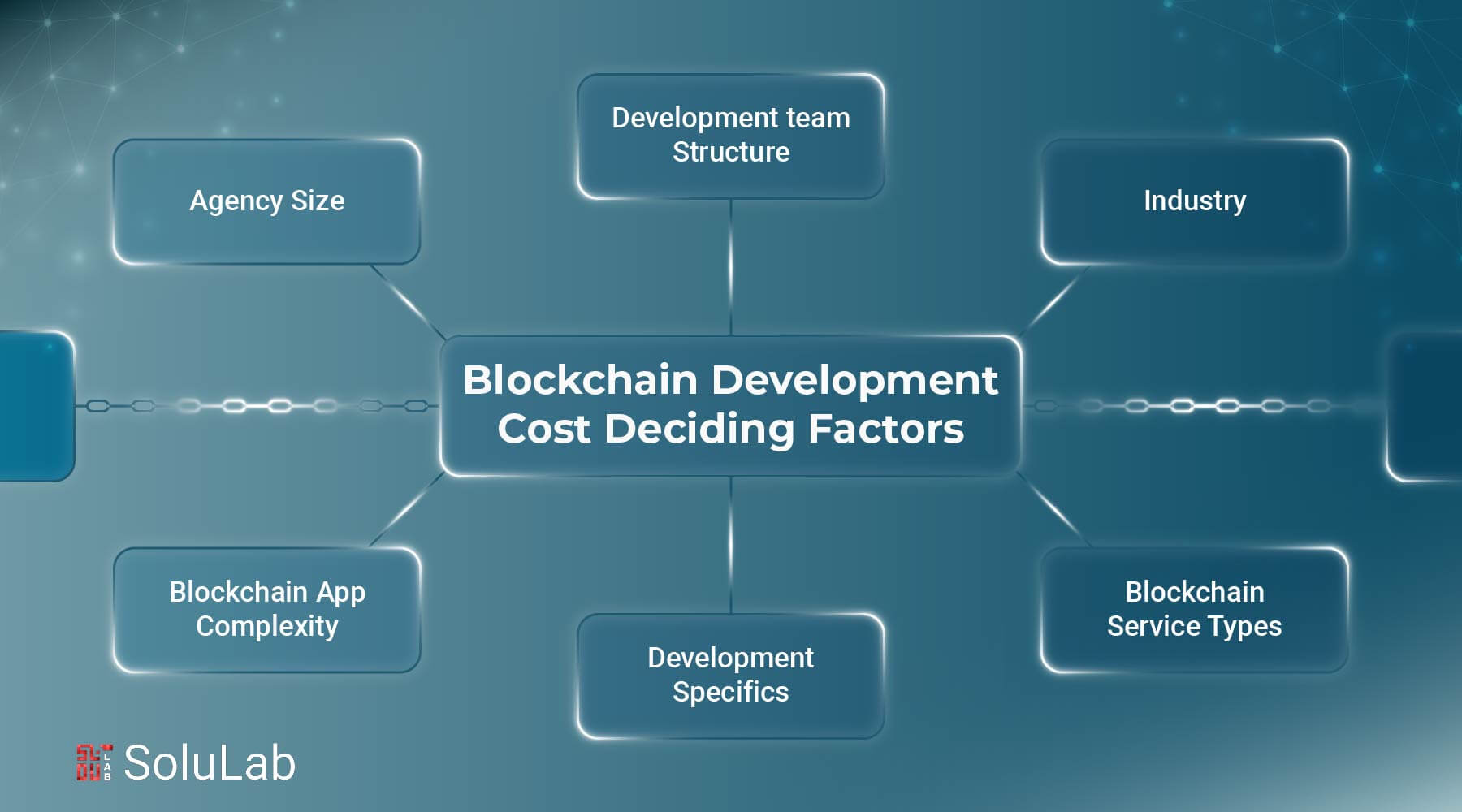

Cost and Implementation Complexity: Adopting on-chain billing (e.g., using Coinbase Commerce or Stripe Crypto) may involve upfront integration costs and require blockchain expertise. Traditional SaaS billing platforms offer plug-and-play solutions but may incur higher ongoing transaction or platform fees.

The rapid evolution of subscription commerce means the gap between these models will only widen as blockchain adoption accelerates. Early adopters are already seeing improved customer retention and reduced operational friction by moving proration logic on-chain.

“Leveraging crypto for SaaS billing brings in more of the unbanked while saving SaaS cost on conventional banking fees. “: TransFi

The future of recurring revenue is programmable, transparent, and borderless, qualities that only blockchain can fully deliver at scale today. As always, your choice should be guided by your specific customer needs, technical resources, and growth ambitions.